Renting vs Buying in Queenstown: Which is Better? in South Africa

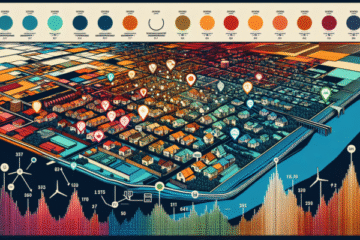

Comprehensive Insight into Queenstown’s Property Market

Understanding Current Trends in Queenstown’s Real Estate

The property market in Queenstown has experienced a remarkable growth trajectory over recent years, reflecting the local economic conditions and significant demographic shifts. The demand for both rental properties and homes for purchase continues to escalate, largely driven by an influx of new residents drawn to the stunning landscapes and lively lifestyle that Queenstown is known for. This surging demand has created a competitive market environment, where potential buyers and renters often face high demand coupled with limited supply, particularly in sought-after suburbs that enhance the overall quality of living.

Additionally, the emergence of remote working has notably influenced property trends in the area. As individuals increasingly seek lifestyle changes, many are relocating from bustling metropolitan hubs to more picturesque destinations like Queenstown. This migration has not only led to an uptick in property prices but has also diversified the types of properties being searched for—there is a marked increase in interest for family homes alongside more affordable entry-level properties designed to cater to first-time buyers and renters. The combination of breathtaking views and a plethora of recreational activities significantly boosts Queenstown’s allure, making it a highly desirable location for a diverse demographic.

Key Economic Influences on Queenstown’s Property Landscape

The economic environment in Queenstown plays a crucial role in shaping the property market. Several vital indicators, including employment rates and GDP growth, directly impact housing demand. The robust tourism sector, which serves as a cornerstone of Queenstown’s economy, is instrumental in job creation and fostering economic stability. When employment rates soar, a greater number of individuals are likely to enter the housing market, whether as renters or buyers, driving up demand and prices for properties.

Furthermore, fluctuations in interest rates can have a profound effect on potential buyers’ purchasing power. Adjustments made by the Reserve Bank can change the affordability of home loans, influencing whether prospective buyers are encouraged or deterred from making a purchase. For example, lower interest rates generally stimulate increased borrowing, offering an incentive for first-time buyers to step into the market. Understanding these economic variables is essential for anyone contemplating renting or purchasing property in Queenstown, as these factors can have both immediate and long-term implications on financial viability.

Examining Demographic Transformations in Queenstown

The demographic landscape of Queenstown is undergoing a substantial transformation, primarily due to an influx of young professionals and families pursuing a balanced lifestyle. This demographic evolution is reshaping the housing market, as newcomers typically have different preferences and priorities when compared to long-term residents. Young professionals often place a premium on proximity to amenities, public transport, and job opportunities, thus driving up demand for affordable rental properties and starter homes.

In contrast, families tend to seek larger homes that boast access to quality schools and recreational facilities. This dual demographic trend has led to a more diversified property market, with a strong emphasis on both rental and entry-level purchasing options. Moreover, this shift is influencing the development of local services and infrastructure, as the need for schools, parks, and community centres rises, ultimately enhancing Queenstown’s appeal as a family-friendly destination.

Financial Aspects of Property Investment in Queenstown

Comparative Cost Analysis: Renting versus Buying

When assessing the financial implications of renting versus buying in Queenstown, it is crucial to evaluate both immediate and long-term costs. Renting usually entails lower upfront financial commitments, such as a security deposit and the first month’s rent, making it a more accessible option for many individuals. This flexibility allows individuals to circumvent the substantial deposit required for purchasing a home, which can present a significant barrier to entry for many aspiring homeowners.

However, while renting may initially appear financially advantageous, it is essential to consider the long-term consequences. Over time, the act of buying a property can lead to considerable savings as mortgage payments contribute to equity rather than merely covering living expenses. In Queenstown, where property values have appreciated significantly, investing in a home could prove to be a wise long-term financial decision. Therefore, potential renters and buyers should conduct a comprehensive cost-benefit analysis, taking into account their financial circumstances, future aspirations, and the prevailing market conditions.

Current Mortgage Rates and Their Availability in Queenstown

In Queenstown, mortgage rates are a critical factor influencing the decision to purchase property. These rates can fluctuate based on a variety of elements, including lenders’ policies and the overall economic landscape. Presently, Queenstown is experiencing competitive mortgage rates, which are particularly attractive for first-time buyers eager to enter the market.

The availability of diverse lending options also plays a significant role in shaping the buying landscape. Numerous banks and financial institutions offer tailored mortgage products that can accommodate different financial situations and preferences. For example, fixed-rate mortgages provide repayment stability over time, whereas variable-rate mortgages may offer lower initial rates but can fluctuate according to market dynamics. Grasping the nuances of these products is essential for potential buyers to make informed decisions, ensuring they choose the best option aligned with their financial capabilities.

Long-Term Financial Advantages of Homeownership

Investing in property in Queenstown yields several noteworthy long-term financial benefits. One of the most significant advantages is the potential for equity accumulation. As property values appreciate over time, homeowners can significantly enhance their net worth. This equity can be leveraged for future investments, thereby bolstering financial security and stability.

In addition, homeowners may benefit from tax advantages related to property ownership, including potential deductions on mortgage interest and property taxes. These financial incentives can enhance overall affordability and return on investment. When contemplating long-term financial planning, it is essential for potential buyers to assess how property ownership in Queenstown can contribute to wealth accumulation, providing a solid foundation for future financial endeavors.

Navigating Property Taxes and Associated Costs in Queenstown

Gaining a comprehensive understanding of property taxes and related costs is vital for anyone considering property investment in Queenstown. Property taxes, imposed by local authorities, can vary based on property value and location. These taxes can significantly impact the overall cost of homeownership, making it essential for buyers to incorporate them into their financial planning.

In addition to property taxes, prospective homeowners should consider other associated expenses, such as maintenance costs, homeowners insurance, and potential homeowner association fees. These costs can accumulate and dramatically influence the affordability and financial viability of purchasing property in Queenstown. Therefore, conducting thorough research and budgeting is critical for anyone contemplating property investment in the area, ensuring they are adequately prepared for the full spectrum of costs involved.

Lifestyle Considerations in Queenstown

The Flexibility Offered by Renting in Queenstown

Renting in Queenstown provides a unique level of flexibility that appeals to a wide range of individuals, particularly those whose life circumstances may frequently change. Tenants enjoy the advantage of being able to relocate with relative ease, as they are not bound by the long-term commitments associated with homeownership. This flexibility can be particularly beneficial for young professionals entering the job market, those engaged in short-term contracts, or individuals who simply wish to explore different areas within the scenic landscapes of Queenstown.

Additionally, renting can enable individuals to reside in desirable locations that might be financially out of reach through purchasing. For instance, a young professional might choose to rent in a prime area near the lake or ski resorts, thereby enjoying an enriching lifestyle without the long-term financial obligations of buying a home. This arrangement allows for an exploration of Queenstown’s diverse neighbourhoods, accommodating changes in personal or professional circumstances without the stress of having to sell a property.

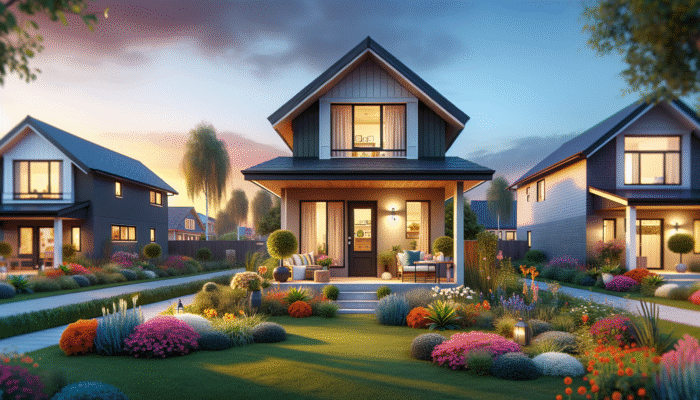

The Stability Associated with Homeownership

Owning a home in Queenstown provides a sense of stability and permanence that many individuals and families find appealing. Homeownership typically leads to a more settled lifestyle, offering the opportunity to establish roots within the community. For families, this stability is often essential, as it enables children to settle into schools and cultivate lasting friendships, fostering a profound sense of belonging.

Moreover, owning a home can facilitate a deeper connection to the community. Homeowners are generally more inclined to engage in local affairs, contributing to neighbourhood initiatives and fostering a sense of civic responsibility. This engagement can lead to enriched social connections and a stronger support network, which is particularly beneficial in a close-knit town like Queenstown. Thus, the stability provided by homeownership extends beyond mere financial investment; it encompasses emotional and social dimensions that enhance one’s overall quality of life.

Community Engagement and Social Dynamics in Queenstown

Living in Queenstown, whether through renting or buying, provides a plethora of community and social benefits. The town is celebrated for its vibrant community spirit, with a wide array of events and activities that promote social interaction among residents. Both renters and homeowners can engage in local festivals, outdoor activities, and community service projects, strengthening their connections with neighbours and local businesses.

Renters may discover that community involvement is often more accessible, as they can explore different areas and social networks without the restrictions of homeownership. Conversely, homeowners are typically more invested in their immediate community, contributing to its development and sustainability. Regardless of housing status, both renters and buyers benefit from the rich tapestry of social opportunities in Queenstown, creating a dynamic environment that encourages interaction and relationships among residents.

Expert Perspectives on Renting vs Buying in Queenstown: Making the Right Choice

Insights from Industry Experts on Market Trends

Industry experts consistently analyse the evolving property market in Queenstown, offering insights that can assist potential renters and buyers in making informed decisions. Many real estate analysts emphasise the current trend of rising property values, indicative of strong demand for both rental and purchased properties. This trend is attributed to Queenstown’s growing appeal as a lifestyle destination, attracting not just local residents but also individuals from other regions and countries.

Experts also advise prospective buyers to remain cautious and consider market fluctuations when making their choices. For example, during periods of high demand, prices can escalate rapidly, making it essential for buyers to act quickly. Conversely, renters may benefit from a more flexible market, allowing them to secure desirable properties without the long-term commitment tied to buying. Real-world examples of both buyers and renters successfully navigating these trends can provide valuable context to the decision-making process, illustrating the opportunities and challenges present in Queenstown’s property landscape.

Guidance from Local Real Estate Professionals

Local real estate agents provide invaluable guidance for individuals contemplating renting or buying in Queenstown. These professionals possess first-hand knowledge of the market and can offer actionable strategies tailored to prospective renters and buyers. For instance, agents often recommend that renters focus on understanding the local rental market—identifying areas that offer the most appealing amenities and access to employment opportunities.

For buyers, agents typically advise conducting comprehensive research on property values and potential investment areas. They may suggest attending open houses, familiarising oneself with local property trends, and connecting with mortgage brokers early in the process. Additionally, agents stress the importance of establishing a realistic budget, which should encompass not only mortgage payments but also ongoing costs such as maintenance and property taxes. By adhering to these expert recommendations, individuals can navigate Queenstown’s competitive property market more effectively, making informed decisions that align with their personal and financial aspirations.

Advice from Financial Planners on Property Decisions

Financial planners play a pivotal role in guiding individuals through the financial implications of renting versus buying in Queenstown. These experts often emphasise the necessity of comprehending one’s financial situation prior to making a decision. They recommend performing a detailed analysis of income, expenses, and savings to determine the most viable option.

When contemplating buying, financial planners typically underscore the importance of examining long-term costs in relation to short-term gains. They often suggest that potential buyers factor in not only the mortgage but also property taxes, maintenance, and other costs associated with homeownership. Conversely, for renters, planners might advocate evaluating the potential to invest the savings accrued from rental payments into other financial vehicles that could yield higher returns over time. This professional insight is invaluable for ensuring that individuals consider all financial aspects before committing to a rental or purchase in Queenstown.

Legal and Regulatory Framework Governing Property in Queenstown

Understanding Property Laws and Regulations

Navigating the legal landscape is imperative for anyone considering renting or buying property in Queenstown. South Africa’s property laws govern various facets of real estate transactions, and being well-versed in these regulations can help individuals avoid common pitfalls. For instance, buyers need to understand the process for transferring ownership, which entails legal documentation and compliance with local laws.

Furthermore, rental agreements are also subject to specific regulations. Tenants and landlords must adhere to the terms outlined in the Rental Housing Act, which protects the rights and obligations of both parties. Familiarising oneself with these laws ensures that individuals engage in legally compliant transactions, safeguarding their interests whether they are renting or purchasing in Queenstown.

Understanding Tenant and Landlord Rights

Both tenants and landlords in Queenstown have specific rights and responsibilities that are essential for maintaining a fair rental environment. Tenants are entitled to reside in a safe and well-maintained property, and landlords are obligated to ensure that properties meet health and safety standards. Understanding these rights enables tenants to advocate for themselves and seek redress if issues arise.

Conversely, landlords have the right to receive rent punctually and expect their property to be treated with respect. They also retain the right to conduct inspections and terminate a lease under certain conditions. Familiarising oneself with these rights and responsibilities is vital for both parties to cultivate a respectful and compliant rental relationship in Queenstown.

Key Elements of Contractual Agreements

When entering into rental or purchase agreements in Queenstown, it is crucial to pay close attention to the contractual terms. For rental agreements, essential elements to scrutinise include the lease duration, rental amount, and conditions regarding termination or renewal. Understanding these clauses can help prevent future disputes and ensure both parties are clear about their obligations.

In the case of purchase agreements, buyers should carefully examine the terms related to the sale price, payment structure, and any contingencies involved. It is advisable to consult with a legal professional who is well-versed in property law to ensure that the contract adequately protects one’s interests. Being diligent in reviewing these agreements can significantly mitigate risks associated with property transactions in Queenstown.

Maintenance Responsibilities and Upkeep in Queenstown

Tenant Responsibilities in Rental Properties

When renting property in Queenstown, tenants generally have fewer maintenance responsibilities compared to homeowners. Typically, the landlord is responsible for significant repairs and ensuring that the property is maintained in accordance with local health and safety regulations. This arrangement allows renters to enjoy their living space without the financial burden of upkeep, making renting an appealing option for many.

However, renters should remain mindful of their responsibilities as well. For instance, tenants are usually expected to maintain cleanliness in the property and promptly report any maintenance issues. Understanding these responsibilities is vital for fostering a good relationship with the landlord and ensuring a positive rental experience in Queenstown. Clear communication regarding maintenance concerns can help prevent misunderstandings and contribute to a harmonious living environment.

Homeowner Maintenance Obligations

Owning a home in Queenstown entails a range of responsibilities, especially concerning maintenance and upkeep. Homeowners are tasked with ensuring that both the interior and exterior of the property are well-maintained. This includes regular tasks such as lawn care, painting, and repairs, along with more significant undertakings like roof maintenance or plumbing repairs.

Beyond routine maintenance, homeowners must also prepare for unforeseen issues, such as appliance failures or weather-related damage. Establishing a maintenance budget can assist homeowners in managing these costs effectively, ensuring that funds are available when needed. Comprehending the scope of these responsibilities is crucial for any prospective buyer in Queenstown, as it can greatly influence their overall homeownership experience.

Financial Implications of Property Upkeep

The financial implications of maintaining a property in Queenstown can vary significantly based on the home’s size, location, and age. Homeowners should anticipate ongoing expenses, including routine maintenance, repairs, and seasonal upkeep. For instance, properties located in areas prone to heavy snowfall may require additional investment in snow removal services, while homes with gardens may incur landscaping costs.

Furthermore, homeowners should be prepared for the financial impact of larger-scale repairs that may arise over time. It is prudent to allocate a portion of the monthly budget for unexpected repairs or renovations, ensuring financial stability when issues occur. By understanding these cost implications, prospective homeowners can better prepare for the financial responsibilities associated with property upkeep in Queenstown.

Research-Driven Advantages of Renting versus Buying in Queenstown

Benefits of Renting: Insights from Research

Research highlights several key advantages associated with renting in Queenstown, which can aid individuals in making informed decisions. These benefits often encompass:

- Lower Upfront Costs: Renting typically entails a lesser financial commitment upfront compared to buying.

- Flexibility: Renting enables individuals to relocate with ease, avoiding the burden of property sales.

- No Maintenance Duties: Landlords handle major repairs, providing peace of mind for tenants.

- Access to Premium Locations: Renters can reside in desirable areas that may be financially impractical for buyers.

These advantages position renting as an appealing option for many individuals, particularly those seeking flexibility and reduced financial risk in a dynamic market such as Queenstown.

Research Findings Supporting Buying Advantages

Conversely, research supports numerous benefits of purchasing property in Queenstown, which can enhance long-term financial stability. Key advantages include:

- Equity Accumulation: Homeownership allows individuals to build equity over time as property values appreciate.

- Tax Benefits: Homeowners may access tax deductions on mortgage interest and property taxes.

- Stability: Owning a home provides a sense of permanence and connection to the community.

- Investment Potential: Property ownership can serve as a robust long-term investment, potentially yielding rental income.

These benefits underscore the potential advantages of homeownership for individuals committed to establishing roots in Queenstown and seeking long-term financial growth.

Comparative Study of Renting and Buying

Expert analysis of recent studies offers a balanced view of the benefits and drawbacks of renting versus buying in Queenstown. While renting provides immediate flexibility and lower upfront costs, buying presents the potential for significant long-term financial gains. For instance, studies suggest that homeowners can dramatically increase their net worth over time through property appreciation, while renters may miss out on the opportunity to build equity.

Moreover, the emotional and social advantages associated with homeownership can significantly influence individual choices. Research indicates that homeowners often report higher levels of satisfaction and community engagement compared to renters. By considering these insights, prospective renters and buyers can develop a nuanced understanding of their options, determining which path aligns best with their personal and financial objectives.

Long-Term Financial Considerations: Renting vs. Buying

Examining the long-term financial implications of renting versus buying in Queenstown is essential for informed decision-making. Research indicates that while renting may offer short-term affordability, homeownership can yield substantial benefits over time. Homeowners typically accumulate equity as property values rise, while renters forfeit this potential gain.

Furthermore, homeownership often provides a hedge against inflation, as mortgage payments remain relatively stable compared to rising rental costs. Long-term financial planning should take these dynamics into account, ensuring that individuals grasp the potential trajectory of their investment, whether they choose to rent or buy in Queenstown. By analysing these implications, one can make a decision that not only addresses immediate needs but also aligns with future financial aspirations.

Impact of Lifestyle and Flexibility on Renting vs Buying Decisions

When evaluating how renting or buying impacts lifestyle and flexibility, it is crucial to consider individual circumstances and goals. Research demonstrates that renting offers unparalleled flexibility, facilitating easier adaptation to changes in job situations or family dynamics. This adaptability can be particularly beneficial for young professionals in Queenstown, who may wish to experience various neighbourhoods or pursue different career opportunities.

Conversely, purchasing a home offers stability and the potential for long-term investment. Homeowners frequently enjoy a sense of belonging and community, which can be fulfilling for families and individuals alike. These lifestyle considerations should be central to the decision-making process, as they can greatly influence overall satisfaction and quality of life, whether renting or buying in Queenstown.

Prospects for the Future of Queenstown’s Property Market

Anticipated Market Trends and Developments

Looking ahead, the property market in Queenstown is set for continued growth, driven by various factors. Experts predict that demand for both rentals and homes for purchase will remain robust due to the area’s allure as a lifestyle destination. As economic conditions stabilise and infrastructure developments progress, potential buyers and renters can expect to encounter ongoing opportunities within the market.

Moreover, demographic trends suggest that younger generations, particularly millennials, will increasingly seek homeownership opportunities as they establish themselves. This shift may catalyse the expansion of entry-level properties and affordable housing options in Queenstown, catering to the needs of first-time buyers. Staying informed about these trends will be crucial for anyone looking to navigate the evolving property landscape effectively.

The Role of Infrastructure Development in Shaping Property Values

Infrastructure development plays a pivotal role in influencing Queenstown’s property market. Planned projects, such as enhanced transport links and community facilities, have the potential to significantly increase property values and desirability. For instance, new roads and public transport options can make previously less accessible areas more attractive to prospective buyers and renters, thereby boosting demand in those locations.

In addition, the establishment of recreational amenities, schools, and shopping centres can further enhance the area’s appeal. As the community grows and evolves, properties located near these developments are likely to experience value appreciation. Understanding how infrastructure projects impact the local market is essential for anyone considering renting or purchasing property in Queenstown, as these factors can greatly influence investment decisions.

The Long-Term Investment Potential of Queenstown Properties

The long-term investment potential of buying property in Queenstown is substantial, particularly given the ongoing demand and market trends. As property values continue to rise, homeowners can anticipate significant returns on their investments over time. This appreciation not only provides financial stability but also opportunities for leveraging equity for future ventures.

Furthermore, Queenstown’s appeal as a tourist destination amplifies its investment potential, as rental properties can generate lucrative short-term rental income. Investors can take advantage of the area’s popularity by providing holiday accommodations, further enhancing their returns on investment. Understanding these dynamics is crucial for anyone considering property investment in Queenstown, ensuring that they make informed decisions that align with their financial aspirations.

Environmental Sustainability Initiatives in Queenstown

The future of Queenstown is increasingly shaped by environmental sustainability initiatives, which are influencing both property values and lifestyle choices. As the community places greater emphasis on conservation and sustainable living, properties that incorporate eco-friendly features may see enhanced desirability and market value.

Local efforts to promote green building practices and sustainable development are becoming increasingly common, reflecting a growing awareness of environmental issues among residents. Properties that offer energy efficiency, renewable resources, or sustainable landscaping may attract environmentally conscious buyers and renters, contributing to a more vibrant and sustainable community. Understanding how these initiatives affect the property market in Queenstown is vital for anyone contemplating making an investment in the area.

Making Informed Decisions in Queenstown’s Property Market

Personal Factors to Consider When Renting or Buying

When contemplating whether to rent or buy in Queenstown, personal circumstances play a pivotal role. Factors such as job stability, income level, and future family plans significantly influence this decision. For individuals with secure employment and a clear vision for the future, homeownership might appear as a more viable option, providing the opportunity to build equity and establish roots within the community.

Conversely, those with uncertain job situations or plans for mobility may find renting to be a more prudent choice. Renting offers flexibility, allowing individuals to adapt to changing circumstances without the burden of property ownership. Evaluating these personal factors is essential for making a decision that aligns with one’s lifestyle and long-term goals in Queenstown.

Assessing the Advantages and Disadvantages

A thorough understanding of the advantages and disadvantages of renting versus buying in Queenstown is crucial for informed decision-making. Key benefits of renting include lower upfront costs, flexibility, and minimal maintenance responsibilities. Conversely, the advantages of buying encompass equity building, tax benefits, and the stability associated with homeownership.

On the flip side, renting can present challenges such as a lack of control over property modifications and potential rent increases, while buying may involve long-term financial commitments and maintenance responsibilities. By carefully weighing these advantages and disadvantages, individuals can better evaluate which option best suits their needs and circumstances in Queenstown, ensuring they make a choice that aligns with their lifestyle and financial objectives.

Essential Next Steps After Making a Decision

Once individuals have reached a decision to rent or buy in Queenstown, there are several critical next steps to follow:

- Research the Market: Gain insight into current rental prices or property values in desired neighbourhoods.

- Engage with Professionals: Consult real estate agents or financial planners to guide your journey.

- Secure Financing: If buying, obtain mortgage pre-approval to clarify your budget.

- Inspect Properties: Schedule viewings to assess rental properties or homes for purchase.

- Review Agreements: Ensure a thorough understanding of rental agreements or purchase contracts before signing.

These steps will assist individuals in navigating their chosen path within Queenstown’s property market, ensuring a seamless transition into their new living situation.

Financial Aspects of Renting versus Buying

The financial implications of renting versus buying in Queenstown are complex and warrant careful consideration. Renting generally involves lower initial costs, such as a security deposit and monthly rent, making it accessible for many individuals. However, potential renters should also reflect on the long-term financial impact of perpetually paying rent without accruing equity.

Buying a home, while necessitating a more substantial upfront investment through a deposit and closing costs, can yield significant long-term financial benefits. Homeowners can build equity as property values appreciate, providing a pathway to future financial stability. It is essential for prospective renters and buyers to evaluate their financial situations, including monthly budgets, savings, and future income prospects, to make decisions that align with their financial goals in Queenstown.

Local Market Trends and Future Outlook

Understanding current market trends and future predictions for Queenstown’s property market is critical for making informed decisions regarding renting or buying. As housing demand continues to rise, prospective buyers and renters can expect increased competition, particularly in desirable areas. Monitoring these trends, including property price fluctuations and rental demand, can aid individuals in anticipating market movements and making timely decisions.

Moreover, experts predict that infrastructure developments and demographic shifts will continue to shape the property landscape in Queenstown. As new amenities arise and the population evolves, individuals must stay vigilant regarding how these factors influence their housing options. By remaining informed about local market trends and future predictions, prospective renters and buyers can better navigate the dynamic property market in Queenstown, ensuring they make choices that align with their long-term goals and aspirations.

Frequently Asked Questions

What advantages does renting in Queenstown offer?

Renting in Queenstown provides flexibility, lower upfront costs, and reduced maintenance responsibilities compared to buying. This arrangement allows individuals to adapt to changing circumstances without long-term financial commitments.

How do property prices in Queenstown compare?

Property prices in Queenstown have been rising due to increased demand and limited supply. This trend necessitates that potential buyers act decisively and remain informed about market conditions.

What factors should I consider before purchasing a property?

Before buying, assess your financial situation, contemplate your long-term plans, and research the local market. It is also advisable to consult with real estate agents and financial planners to guide your decision.

Are there tax benefits associated with homeownership?

Yes, homeownership often offers tax deductions on mortgage interest and property taxes, enhancing the financial appeal of owning a home in Queenstown.

How much should I budget for maintenance as a homeowner?

It is prudent to set aside approximately 1% to 3% of your property’s value annually for maintenance and repairs, ensuring you are prepared for unexpected expenses.

What rights do tenants hold in Queenstown?

Tenants in Queenstown have rights to a safe and well-maintained property, timely repairs, and fair treatment, as outlined under the Rental Housing Act.

How can I locate rental properties in Queenstown?

Utilising local real estate websites, connecting with real estate agents, and exploring community boards can assist you in finding rental listings in Queenstown.

What elements influence mortgage rates in Queenstown?

Mortgage rates are affected by factors such as the Reserve Bank’s interest rates, economic conditions, and individual credit scores, which can greatly influence affordability.

Is it more advantageous to rent or buy in Queenstown?

The decision to rent or buy hinges on personal circumstances, financial situations, and lifestyle preferences. Evaluating the pros and cons of both options is essential for making an informed choice.

What are the anticipated future trends for the property market in Queenstown?

Experts predict ongoing growth in Queenstown’s property market, influenced by demographic shifts and infrastructure developments that may enhance property values and investment opportunities.