Spotting Prime Entry-Level Investments in Bethlehem: South Africa

Navigating Bethlehem’s Dynamic Real Estate Market

What Key Elements Affect Property Values in Bethlehem?

In Bethlehem, multiple crucial factors contribute to the fluctuations in property values. A primary influence is location, where properties positioned near vital amenities such as schools, healthcare facilities, and shopping centres generally appreciate more than those in less accessible locations. Properties in proximity to main thoroughfares or public transport hubs are particularly appealing to buyers, enhancing their investment potential significantly. The desirability of these locations often leads to increased property values and quicker sales.

Equally important is the aspect of accessibility. Areas with effective transport networks frequently experience heightened demand, thereby driving property prices upwards. Investors should remain vigilant regarding current and future infrastructure projects, as these developments can substantially improve accessibility and consequently influence property values over time.

Local amenities such as parks, leisure centres, and community services significantly impact property valuations as well. Neighbourhoods that foster vibrant community lifestyles and provide easy access to recreational activities are particularly attractive to families and young professionals, which drives up demand and property prices, making them prime candidates for entry-level investments.

Moreover, the socio-economic landscape of the neighbourhood plays a vital role in influencing values. Areas characterised by robust job markets and growing populations typically witness increased demand for housing. Investors need to adopt a comprehensive perspective, analysing all these factors when considering potential properties in Bethlehem.

Exploring Bethlehem’s Economic Expansion and Property Market Trends

Bethlehem’s economic framework is marked by steady growth and a transformative property market. The local economy has displayed resilience, supported by a diverse base encompassing retail, agriculture, and emerging sectors such as technology and renewable energy. This economic variability fosters a strong demand for housing, positively impacting property values.

Keeping an eye on economic indicators like employment rates, average income levels, and population growth can offer valuable insights into future property demands. Consistent job creation typically results in an influx of new residents, which subsequently escalates the need for housing. Investors should remain alert to these trends, as they can reveal promising areas for investment.

Additionally, a close examination of property trends in Bethlehem uncovers patterns such as rising prices in previously underserved areas. For example, properties in emerging neighbourhoods may currently be priced lower but hold significant appreciation potential as the area develops and demand increases.

Investors are encouraged to conduct thorough market research, analysing historical price trends, current listings, and sold properties to forecast future movements. This data-driven strategy can effectively identify the most promising investment opportunities within Bethlehem’s dynamic landscape.

Identifying Prime Entry-Level Investment Areas in Bethlehem

Recognising key districts for entry-level investments in Bethlehem is essential for astute investors. Certain neighbourhoods within the city are noteworthy due to their affordability and potential for growth. Areas like Heidelberg and Fichardt Park are frequently recognised as ideal locations for new investors, primarily due to their relatively low property prices and the rising demand from young families and first-time buyers.

Another promising area is Westonaria, which has recently undergone development projects aimed at enhancing local amenities and infrastructure. Its proximity to major transport routes and employment hubs has led to its growing popularity. Investors interested in properties in this region should focus on those situated near upcoming commercial developments, as these are likely to increase in value.

Additionally, central Bethlehem presents a unique blend of convenience and charm, making it attractive to young professionals. Properties in this region are often highly sought after due to their access to public transport and local services. Investing in central locations can yield significant returns, especially as urban living gains popularity.

Investors should engage in comprehensive research about these areas, scrutinising factors like historical growth rates, vacancy rates, and future development plans. Gaining insights from local real estate agents can further enrich their understanding and lead to well-informed investment decisions.

Valuable Insights for Identifying Prime Entry-Level Investments in Bethlehem

What Attributes Define an Expert in Bethlehem’s Real Estate Market?

An expert in Bethlehem’s real estate landscape brings a blend of experience and specialised knowledge that is invaluable for investors. Typically, these professionals possess extensive market experience that spans several years, equipping them with the ability to pinpoint key trends and opportunities. Their insights are rooted in a thorough understanding of local demographics, property values, and market fluctuations.

Essential qualifications for a real estate expert in Bethlehem include:

- Comprehensive knowledge of local market dynamics and trends.

- Strong analytical skills to interpret data and forecast market movements.

- Proven experience in successfully negotiating property deals.

- A well-established network of contacts within the industry, including fellow investors, agents, and service providers.

- A thorough understanding of the legal and regulatory frameworks governing property transactions.

- The ability to provide sound advice based on historical data and current market conditions.

- Exceptional communication skills to articulate insights effectively.

- A track record of successful investments within the Bethlehem area.

Such qualifications empower experts to guide investors through the complexities of the property market, ensuring that their decisions are informed and strategically sound.

How Can Real-World Investment Success Stories Serve as Examples?

Real-world success stories in property investment can illuminate effective pathways for investing in Bethlehem. For instance, an investor who acquired a modest flat in Fichardt Park three years ago for R600,000 has witnessed the property value soar to R850,000, driven by local infrastructure enhancements and the increasing demand from first-time buyers. This case exemplifies the substantial appreciation potential when investing in developing areas.

Moreover, another investor focused on purchasing duplexes in Heidelberg that were previously undervalued. By renovating these properties and enhancing their appeal, the investor boosted rental income by over 30%, maximising their return on investment. These practical examples underscore the importance of selecting the right property and having a deep understanding of local rental markets.

Investors can also look to developments in Westonaria, where a series of new shopping centres and schools have revitalised the area. An investor who procured land and developed residential units near these new amenities has experienced a surge in tenant interest, reflecting the critical role of location and accessibility in achieving investment success.

These examples illustrate that informed, strategic investments can yield excellent returns. They serve as valuable guides for new investors, highlighting the importance of thorough market research, awareness of local trends, and making data-driven decisions.

What Actionable Steps Should Be Taken to Evaluate Properties?

Evaluating properties in Bethlehem necessitates a methodical and clear approach to ensure well-informed investment decisions. Here are actionable steps that investors can follow to effectively assess potential properties:

1. Conduct a Market Analysis: Start by researching the local property market, honing in on areas of interest. Examine historical price trends, current listings, and sold prices to gauge the market’s health and identify opportunities.

2. Visit the Property: Schedule a property visit to assess its condition. Pay close attention to the overall state of the building, the quality of materials used, and any visible maintenance issues.

3. Evaluate Local Amenities: Consider the proximity to essential amenities such as schools, healthcare, and shopping facilities. Properties near these conveniences tend to be more desirable, influencing long-term value.

4. Inspect the Property’s Condition: Conduct a comprehensive inspection, focusing on critical areas such as the roof, plumbing, and electrical systems. Identify any potential issues that may necessitate immediate attention or investment.

5. Review the Title and Legal Documents: Ensure the property’s title deed is clear and free from legal encumbrances. Understanding zoning laws and local regulations is also vital.

6. Seek Professional Advice: Engage with real estate agents or property experts familiar with Bethlehem’s market. Their insights can provide additional context and help avoid common pitfalls.

7. Consider Future Developments: Investigate any planned infrastructure or commercial developments in the vicinity. Such projects can significantly impact property values and desirability.

By following these steps, investors can make informed decisions that enhance their investment outcomes. Thorough evaluations reduce risks and help uncover properties with strong growth potential.

Legal Insights for Property Investment in Bethlehem

What Are the Essential Legal Requirements for Purchasing Property?

Grasping the legal requirements for buying property in Bethlehem is a vital step for any investor. The process encompasses several key elements, starting with the necessity for a title deed, which is crucial for establishing ownership. Ensuring that the title is free from disputes or encumbrances is vital for protecting the investment.

Investors should also familiarise themselves with zoning laws, which govern how properties can be utilised. Understanding these regulations ensures that the intended use of the property aligns with local laws, preventing potential legal complications in the future.

The property transfer process typically requires hiring a conveyancer, who will manage the legal documentation necessary for the transfer of ownership. This includes drafting the sale agreement, lodging it with the Deeds Office, and ensuring compliance with all legal prerequisites.

Additionally, investors should be aware of the implications of property transfer taxes and registration fees, which can add considerable costs to the transaction. Understanding these financial obligations ahead of time aids in budgeting and financial planning.

It is advisable for investors to carry out thorough due diligence, which includes verifying the seller’s legitimacy and understanding any potential legal risks associated with the property. Engaging a knowledgeable attorney with experience in local real estate matters can provide further reassurance and guidance throughout the purchasing process.

How to Navigate Property Taxes and Fees in Bethlehem?

Understanding property taxes and associated fees is essential, as they can significantly impact an investor’s return on investment in Bethlehem. A clear grasp of these costs is crucial for effective financial planning and profitability.

In Bethlehem, property owners are subject to municipal rates calculated based on the property’s valuation. Investors should note that these rates can vary significantly based on the property’s location and size. It is essential to check with the local municipality for the most accurate and current rates applicable to the property in question.

In addition to municipal rates, transfer duties payable to the South African Revenue Service (SARS) are applicable when purchasing property. These duties are calculated as a percentage of the purchase price and can considerably increase the overall cost, making it vital for investors to factor these into their financial calculations.

Moreover, ongoing maintenance costs and homeowners’ association fees may apply, particularly in sectional title properties. These fees can vary widely, so it is critical to request detailed breakdowns before finalising any purchase.

Investors should also keep in mind that local economic conditions can affect property taxes and fees. For instance, economic growth may lead to higher property valuations, resulting in increased municipal rates. Therefore, staying informed about local economic trends is essential for effectively managing these costs.

By understanding these financial aspects, investors can make better-informed decisions and strategise their investments to maximise returns while minimising unexpected expenses.

Why Is Legal Due Diligence Crucial?

Conducting comprehensive legal due diligence is vital for securing property investments in Bethlehem. This process involves thoroughly examining all legal aspects related to the property, ensuring that no hidden issues could jeopardise the investment.

A primary component of due diligence is verifying the property’s title deed. Investors must confirm that the title is free from any legal disputes or encumbrances, which could complicate ownership in the future. This verification includes checking for any claims against the property, such as mortgages, liens, or disputes with neighbours.

Moreover, understanding the zoning laws that apply to the property is critical. These regulations dictate how the property can be used and can significantly impact its value and development potential. Investors should ensure that their intended use aligns with local zoning regulations to avoid legal complications.

Engaging a qualified attorney during this phase is highly recommended. A legal expert can assist in reviewing contracts, ensuring compliance with local laws, and mitigating any risks associated with the transaction. They can also provide insights into any legal changes that may affect property ownership and use in the future.

Additionally, conducting background checks on the seller can reveal important information about their history and any potential legal issues. This step is crucial to prevent future surprises and ensure a smooth transaction process.

By prioritising legal due diligence, investors can safeguard their investments, enhancing their overall confidence in the buying process and minimising the risk of future disputes or financial losses.

Financial Considerations for Investing in Bethlehem

How to Secure Financing for Entry-Level Properties?

Securing financing for entry-level properties in Bethlehem is a fundamental step for investors looking to enter the real estate market. A variety of financing options are available, ranging from traditional bank loans to alternative financing methods. Understanding these options can significantly facilitate the investment process.

One of the most common financing methods is obtaining a mortgage from a bank or lending institution. Investors should explore different mortgage products available, including fixed-rate and adjustable-rate mortgages. It is essential to compare interest rates, terms, and conditions from various lenders to find the best fit for their financial situation.

In addition to traditional mortgages, investors might consider government-backed loans, which can offer favourable terms such as lower down payments or reduced interest rates. Programs aimed at first-time homebuyers or those investing in affordable housing can provide additional opportunities to secure financing.

Another option is to seek financing through private lenders or real estate investment groups. These alternatives often come with less stringent qualification criteria and a faster approval process. However, investors should be mindful of potentially higher interest rates and ensure they conduct thorough research on the credibility of these lenders.

Furthermore, having a solid financial plan and a good credit score can enhance an investor’s chances of securing favourable financing terms. It is advisable to prepare comprehensive financial documentation, such as proof of income, credit history, and debt-to-income ratios, to present to lenders.

By exploring all available financing options and preparing adequately, investors can navigate the financial landscape effectively, facilitating their entry into the Bethlehem real estate market.

How to Calculate ROI for Properties in Bethlehem?

Calculating the return on investment (ROI) for properties in Bethlehem is an essential skill for any investor. Understanding how to accurately assess ROI allows investors to evaluate the viability of their investments and make informed decisions.

To calculate ROI, investors can use the formula:

ROI = (Net Profit / Total Investment) x 100

To start, investors must determine their total investment costs, including the purchase price, closing costs, renovation expenses, and any other related fees. Next, they need to estimate the potential rental income or resale value of the property once it is fully operational or renovated.

The net profit is calculated by subtracting the total investment from the total income generated over a specific period, typically a year. For instance, if an investor purchases a property for R1,000,000, spends R100,000 on renovations, and generates R150,000 in rental income, the ROI would be calculated as follows:

1. Total Investment: R1,000,000 + R100,000 = R1,100,000

2. Net Profit: R150,000 – R1,100,000 = R150,000

3. ROI: (R150,000 / R1,100,000) x 100 = 13.64%

This calculation provides a clear view of the investment’s performance. Investors should also consider factors such as market conditions and property appreciation potential when evaluating ROI.

Regularly recalculating ROI as property values and rental income change can help investors make timely and informed decisions regarding their portfolios.

How to Budget for Renovations and Upgrades Effectively?

Budgeting for renovations and upgrades is vital for property investors in Bethlehem. Proper planning ensures that these improvements enhance property value without straining finances.

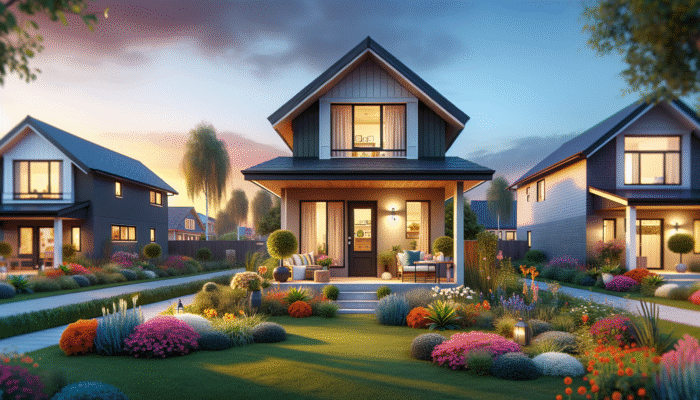

To begin, it is crucial to conduct a thorough assessment of the property to identify necessary renovations. Common upgrades may include refreshing the interior, updating kitchens or bathrooms, and enhancing curb appeal through landscaping.

Once necessary renovations have been identified, investors should establish a detailed budget. This budget should encompass the costs of materials and labour while allocating funds for unexpected expenses. It is prudent to include an additional 10-20% contingency to accommodate any unforeseen costs that might arise during the renovation process.

Utilising professional contractors can provide a clearer picture of potential costs and help avoid costly errors. Obtaining multiple quotes for each aspect of the renovation ensures competitive pricing.

Understanding the potential return on investment for each upgrade is crucial. Certain renovations may yield better returns than others, so prioritising those that significantly enhance property value can lead to better long-term gains.

Investors should also consider current market conditions and buyer preferences when planning renovations. Focusing on modern, energy-efficient upgrades can attract more tenants or buyers, further increasing the property’s appeal and value.

By budgeting wisely and planning renovations and upgrades strategically, investors can maximise their returns and enhance the attractiveness of their properties within Bethlehem’s competitive real estate market.

Research-Driven Advantages of Identifying Prime Entry-Level Investments in Bethlehem

What Are the Long-Term Benefits of Early Investments?

Investing early in Bethlehem’s real estate market can yield significant long-term benefits that often outweigh initial investment costs. One of the most notable advantages is the potential for property appreciation. Properties bought at lower prices can substantially increase in value as the area develops and demand for housing rises.

Early investors often enjoy a first-mover advantage, enabling them to secure prime locations before prices escalate. As demand increases, these properties can appreciate more rapidly, providing substantial returns over time.

Moreover, investing early allows for greater flexibility in decision-making. Investors can implement renovations or improvements without the pressure of a highly competitive market. This flexibility often results in higher rental yields and increased property value.

Additionally, early investments can generate passive income through rental returns. Investors who acquire properties in emerging areas may find steady demand from tenants, producing reliable cash flow that can be reinvested or used to fund further investment opportunities.

Overall, the long-term benefits of early investment in Bethlehem’s real estate market can lead to enhanced financial stability and wealth accumulation. Investors should remain vigilant and proactive in identifying opportunities to capitalise on these benefits.

How to Analyse Market Trends for Informed Investment Decisions?

Engaging in expert analysis of market trends in Bethlehem is vital for making informed investment decisions. Understanding the current state of the market and potential future shifts can provide investors with a competitive advantage.

Key trends to monitor include population growth, which typically drives demand for housing. As Bethlehem continues to attract new residents, particularly young professionals and families, the need for affordable and quality housing increases, creating opportunities for investors.

Another trend to consider is the development of infrastructure. New transportation links, schools, and commercial establishments can enhance the desirability of certain areas. Investors should keep an eye on proposed developments, as these can signal potential appreciation in property values.

Furthermore, analysing rental market trends, including average rental prices and occupancy rates, can provide insights into the viability of potential investments. A growing rental market often indicates strong demand, suggesting that properties in the area will remain sought after.

Investors should also be aware of macroeconomic factors, such as interest rates and economic growth projections, which can influence property demand and financing options. Regularly reviewing expert analyses and reports can equip investors with the knowledge needed to navigate the ever-changing landscape of Bethlehem’s real estate market effectively.

By staying informed about market trends and expert insights, investors can make strategic decisions that align with current conditions and future opportunities, maximising their potential for success.

What Successful Early Investment Case Studies Should Investors Examine?

Examining case studies of successful early investments in Bethlehem can provide invaluable insights for new investors. For instance, one investor who purchased a modest residential unit in Fichardt Park for R500,000 five years ago has seen the property appreciate to R750,000, driven by the area’s increasing popularity among young professionals.

Another notable example involves a group of investors who identified a developing neighbourhood near Westonaria and acquired multiple properties before prices surged. Through strategic improvements and effective marketing, they successfully increased rental income by 40%, demonstrating the potential for substantial returns in emerging markets.

Investors who acted early in central Bethlehem during a revitalisation period also reported similar successes. By purchasing properties at lower price points and enhancing them, these investors capitalised on the area’s increasing desirability as new shops and services opened nearby.

These case studies highlight essential strategies for success, including the importance of recognising market trends, conducting thorough research, and being proactive in property selection. Learning from these successful early investments can empower new investors to make informed decisions and maximise their returns in Bethlehem’s evolving real estate market.

Assessing Property Condition in Bethlehem

What Key Aspects Should Be Evaluated During a Property Inspection?

A comprehensive property inspection is crucial for identifying potential issues that could affect the investment value. Investors should focus on several critical areas during the inspection process to ensure they make an informed purchase.

Firstly, assess the property’s structural integrity. This includes checking for cracks in the foundation, sagging roofs, and signs of water damage. Any structural issues can be costly to rectify and may influence the property’s long-term value and safety.

Next, examine the electrical and plumbing systems. Ensure that all outlets, switches, and fixtures are functional, and check for any leaks or signs of corrosion in plumbing. Outdated electrical systems can pose safety hazards and may require expensive upgrades, making it essential to verify their condition.

Investors should also evaluate the condition of windows, doors, and insulation. Proper sealing and insulation are critical for energy efficiency and can significantly impact ongoing utility costs. Look for signs of wear, drafts, or water infiltration that could indicate necessary repairs.

Don’t forget to inspect the exterior, including the roof, gutters, and landscaping. A well-maintained exterior not only enhances curb appeal but can also prevent future maintenance issues.

Finally, consider hiring a professional inspector for a thorough assessment. While this may incur an additional cost, the insights gained can save investors from unforeseen expenses and help negotiate better purchase terms.

By paying close attention to these critical areas during a property inspection, investors can protect their investments and ensure they make informed decisions that align with their financial goals.

Why Are Professional Property Assessments Important?

Engaging professionals for property assessments is crucial for making informed investment decisions in Bethlehem. Professional assessments provide a comprehensive, unbiased evaluation of a property’s condition and potential issues that may not be evident during a casual walkthrough.

One significant benefit of hiring a qualified property inspector is their expertise in identifying hidden problems. These experts can detect issues such as structural weaknesses, plumbing failures, or electrical hazards that an untrained eye might overlook. This thorough evaluation equips investors with the information needed to negotiate repairs or adjust their offer accordingly.

Furthermore, professional assessments offer a detailed report, which serves as a valuable tool during the negotiation process. Having a documented account of the property’s condition can help in advocating for price reductions or requesting repairs before closing the sale.

Investors should also consider obtaining specialised assessments for specific concerns. For instance, if a property is in an area prone to flooding, engaging an expert to evaluate flood risks and mitigation strategies can provide crucial insights. Similarly, having a professional contractor assess potential renovation costs can help in budgeting accurately.

In summary, professional property assessments are instrumental in safeguarding investments and ensuring that investors make informed decisions. By leveraging the expertise of qualified professionals, investors can navigate the complexities of property evaluation, leading to more successful investment outcomes.

What Are Effective DIY Tips for Evaluating Property Condition?

For investors looking to save on costs, several DIY tips can aid in evaluating property condition effectively. While professional assessments are invaluable, understanding the basics allows investors to conduct preliminary evaluations before deciding to proceed with purchase negotiations.

Firstly, begin with the exterior of the property. Look for signs of wear and tear, such as peeling paint, damaged roof shingles, or cracked paving. A well-maintained exterior not only enhances curb appeal but can indicate how well the property has been cared for over the years.

Next, inspect the interior rooms, focusing on flooring, walls, and ceilings. Look for water stains, which could signal plumbing issues or roof leaks. Pay attention to the condition of windows and doors; check for drafts or difficulty in opening and closing, which may indicate poor insulation or maintenance.

Furthermore, take note of any odours present in the property. Unpleasant smells can indicate underlying problems such as mould, mildew, or pest infestations. While some issues may be easily rectified, others could result in costly repairs.

For systems like heating and air conditioning, check the age of the units and their general functionality. Ensure they are operational, and inquire about their maintenance history. Older systems may require replacement or upgrades, which can impact overall investment costs.

Lastly, consider conducting a simple moisture test by inspecting basements and crawl spaces for signs of dampness or condensation. This assessment can help detect potential future issues before they escalate.

By employing these DIY tips, investors can gain valuable insights into a property’s condition, enabling them to make more informed decisions while minimising initial costs.

What Common Issues Are Found in Bethlehem Properties?

Investors should be aware of common issues that frequently arise in Bethlehem properties. Understanding these issues can help during property evaluations and enhance negotiation power when purchasing.

One prevalent issue is roof leaks. Many properties experience wear and tear due to weather conditions, and roofs may require repairs or replacement. Identifying signs of leakage, such as water stains on ceilings or walls, is crucial for determining the property’s overall integrity.

Another common concern is outdated electrical systems. Many older properties may not meet modern safety standards or may require upgrades to accommodate contemporary living standards. Investors should pay attention to fuse boxes, wiring conditions, and the number of outlets available.

Moreover, issues with plumbing systems can also be prevalent in older homes. Look for signs of leaks, corrosion, or low water pressure. These problems can lead to costly repairs if not addressed promptly, making it essential to assess the plumbing thoroughly.

Additionally, foundation cracks may be another issue found in some properties. Small cracks can be typical in older homes; however, larger cracks may indicate significant structural issues. Investors should inspect foundations carefully to determine the extent of any damage.

Finally, properties may suffer from poor insulation or inadequate heating and cooling systems. This can lead to high energy costs and discomfort for occupants, impacting rental viability. Assessing insulation levels and HVAC systems can provide insights into potential renovation needs.

Being aware of these common issues allows investors to approach property evaluations with a discerning eye, ensuring they are well-prepared to handle any challenges that may arise in their investment journey.

How Does Local Climate Impact Property Condition?

The local climate in Bethlehem can significantly influence property conditions and long-term maintenance planning. Investors should be mindful of how climatic factors affect properties throughout the year.

Bethlehem experiences a semi-arid climate, characterised by hot summers and cold winters. These temperature fluctuations can impact various aspects of property conditions, particularly roofing materials and insulation. Proper insulation is essential for maintaining comfortable indoor temperatures, reducing energy costs, and preventing issues such as condensation.

Moreover, the region may experience periods of heavy rainfall, leading to increased moisture levels in properties. This can result in issues such as mould growth, deteriorating building materials, and even foundation damage. Investors should pay particular attention to drainage systems and ensure that properties are equipped with adequate protection against water infiltration.

Additionally, prolonged exposure to UV radiation during sunny periods can cause wear and tear on exterior materials, such as paint, siding, and roofing. Regular maintenance of these surfaces helps prolong their lifespan and maintain curb appeal.

To mitigate climate-related issues, investors should consider conducting seasonal checks on properties. This includes inspecting roofs and gutters after heavy rainfall, checking for signs of dampness, and ensuring adequate ventilation throughout the year.

By understanding the local climate’s impact on property conditions, investors can implement proactive maintenance strategies that safeguard their investments and optimise long-term value.

Strategies for Negotiating Property Deals in Bethlehem

How to Effectively Approach Sellers in Bethlehem?

Approaching sellers in Bethlehem requires a nuanced understanding of local customs and market dynamics. Building rapport with sellers can significantly influence negotiation outcomes and lead to more favourable deals.

Begin by conducting thorough research on the property and the seller’s circumstances. Understanding their motivations for selling—whether for financial reasons, relocation, or personal circumstances—can provide leverage during negotiations. Presenting yourself as an informed and serious buyer can help establish trust and goodwill.

When meeting with sellers, adopting a friendly yet professional demeanour is essential. Engaging in conversation about the property and demonstrating genuine interest can help create a connection. Sellers are often more inclined to negotiate with buyers who show appreciation for their property.

Moreover, consider making an offer that reflects the current market value while still allowing room for negotiation. Presenting a well-researched offer can demonstrate your seriousness and knowledge of the property. Be prepared to justify your offer with comparable sales data to strengthen your position.

Lastly, remain flexible and open to negotiations. Listen actively to the seller’s concerns and be willing to adjust your terms if necessary. This collaborative approach can lead to a mutually beneficial agreement, promoting a smoother transaction process.

By utilising these strategies, investors can enhance their negotiation skills and improve their chances of securing favourable deals in Bethlehem’s competitive real estate market.

What Techniques Enhance Price Negotiation Effectiveness?

Effective price negotiation is a critical skill for property investors in Bethlehem. Employing specific techniques can significantly impact the final purchase price and overall deal structure.

One effective approach is to start with comparative market analysis. By researching recent sales of similar properties in the area, investors can establish a reasonable price range. Presenting this data during negotiations can justify your offer and demonstrate that it is grounded in market reality.

Another technique involves highlighting any issues identified during the property inspection. If there are necessary repairs or maintenance concerns, these can serve as negotiation points to support a lower offer. Sharing specific estimates for repairs or improvements can provide a solid argument for price reduction.

Additionally, employing the strategy of anchoring can be beneficial. Starting negotiations with a slightly lower offer than what you are willing to pay can shape the negotiation landscape. This initial offer sets a reference point, allowing for movement towards a mutually agreeable price.

Maintaining a friendly but firm tone throughout the negotiation process is vital. Respectful communication fosters goodwill, making sellers more inclined to consider your proposals. Furthermore, being transparent about your budget constraints can encourage sellers to find solutions that meet your needs.

Lastly, be prepared to walk away if the terms do not align with your investment goals. Showing that you are not overly attached to the property can empower you during negotiations, signalling to the seller that you are serious about securing a fair deal.

By employing these techniques, investors can navigate price negotiations with confidence, leading to more favourable outcomes in Bethlehem’s property market.

How to Leverage Market Knowledge in Negotiations?

Having a deep understanding of Bethlehem’s real estate market offers significant advantages during negotiations. Market knowledge equips investors with the insights needed to make informed decisions and advocate effectively for their interests.

Investors should begin by researching local market trends, including property appreciation rates, average days on the market, and neighbourhood demand. This data can help investors determine whether a property is fairly priced or overpriced, providing a solid foundation for negotiations.

When assessing properties, consider the local context, including recent transactions and the overall economic landscape. Understanding factors such as supply and demand dynamics can help in justifying offers and counteroffers. For instance, if there is a surplus of properties for sale in a particular area, this may provide leverage to negotiate a lower price.

Moreover, being familiar with the seller’s situation can enhance negotiation effectiveness. If a seller is under pressure to sell quickly due to relocation or financial circumstances, this insight can inform your negotiation strategy, allowing for a more advantageous offer.

Incorporating market knowledge into your negotiations also involves presenting data on similar properties and their sale prices. By backing up your proposals with concrete evidence, you can demonstrate that your offers are grounded in reality rather than arbitrary figures.

By leveraging comprehensive market knowledge, investors can navigate negotiations more effectively, ultimately leading to better purchase terms and maximising their investment potential in Bethlehem.

What Are the Legal and Regulatory Considerations in Property Deals?

Understanding the legal and regulatory aspects of property deals in Bethlehem is essential for successful negotiations and transactions. Familiarity with local laws and regulations ensures that investors can navigate the purchasing process smoothly and avoid potential legal pitfalls.

One of the first considerations is the legal framework governing property transactions. Investors should be aware of the requirements for property transfer, including the necessity for a conveyancer, who plays a key role in managing the legal documentation and ensuring compliance with local laws.

Additionally, investors must understand the implications of zoning laws, which can dictate how a property can be used. Knowledge of these regulations helps investors evaluate whether their intended plans align with local laws, minimising the risk of future complications.

Another important aspect is the potential for property taxes and associated fees during the transaction process. Investors should familiarise themselves with any applicable taxes and fees, which can impact the overall cost of purchasing a property. Proper budgeting for these expenses is crucial for maintaining financial viability.

Furthermore, being informed about any recent regulatory changes in Bethlehem can provide insights into the evolving landscape of property investing. New regulations may affect property values or the availability of financing options, so staying updated is essential for informed decision-making.

Engaging with a knowledgeable real estate attorney is advisable to ensure compliance with all legal requirements and to facilitate a correct understanding of the transaction’s implications. Their expertise can be invaluable in navigating complex legal aspects and ensuring a smooth transaction process.

By understanding and navigating the legal and regulatory considerations of property deals in Bethlehem, investors can enhance their confidence and reduce the risks associated with property transactions.

Establishing a Network in Bethlehem’s Real Estate Community

What Advantages Does Networking Provide in Bethlehem?

Networking within Bethlehem’s real estate community offers numerous benefits that can significantly enhance an investor’s success. Building relationships with industry professionals fosters collaboration, access to insider information, and increased opportunities for property deals.

First and foremost, networking can provide investors with access to exclusive listings and off-market properties. Local agents and industry contacts often share opportunities that have not yet been publicly advertised, allowing investors to gain a competitive edge in securing desirable properties.

Moreover, networking enables investors to gain valuable insights from seasoned professionals. Engaging with experienced investors, property managers, and real estate agents can provide a wealth of knowledge regarding local market trends, investment strategies, and common pitfalls to avoid.

Building a strong network also facilitates collaboration on joint ventures or partnerships. By pooling resources and expertise, investors can tackle larger projects or share risks, ultimately leading to more significant returns.

Additionally, networking events, seminars, and workshops provide educational opportunities that enhance investors’ skills and knowledge. Staying informed about the latest industry developments and market dynamics is crucial for making informed investment decisions.

Lastly, a robust network can offer support and camaraderie during both the challenges and triumphs of property investment. Having a community of like-minded individuals to share experiences with can enhance motivation and provide encouragement throughout the investment journey.

By actively participating in Bethlehem’s real estate community and building a strong network, investors can unlock doors to new opportunities and position themselves for greater success in their property investment endeavours.

How Can Local Real Estate Groups and Associations Benefit Investors?

Participating in local real estate groups and associations can significantly benefit investors in Bethlehem. These organisations offer a range of resources, networking opportunities, and educational programmes that can enhance an investor’s knowledge and facilitate connections within the industry.

Joining a local real estate association provides access to a community of like-minded individuals who share similar interests and goals. This environment fosters collaboration and the exchange of ideas, allowing investors to learn from one another’s experiences and insights.

Additionally, many associations offer educational resources, such as workshops, seminars, and guest speaker events. These events often cover critical topics, including market analysis, investment strategies, and best practices for property management. Investors who actively engage in these educational opportunities can stay informed about the latest trends and developments in Bethlehem’s real estate market.

Local real estate groups also provide access to valuable industry contacts, including agents, contractors, and service providers. Building relationships with these professionals can open doors to partnerships, joint ventures, and exclusive property deals that may not be available to the general public.

Moreover, being part of a group can enhance credibility and authority in the market. This affiliation can help investors build trust with potential clients, partners, and lenders, ultimately leading to more successful transactions.

By joining local real estate groups and associations, investors can enhance their network, gain valuable insights, and position themselves for success in Bethlehem’s real estate market.

Why Are Attendance at Property Investment Seminars and Workshops Important?

Attending property investment seminars and workshops is a valuable strategy for investors looking to deepen their knowledge and expand their network within Bethlehem. These events offer a wealth of information and insights that can significantly enhance an investor’s success.

One of the primary benefits of attending seminars is the opportunity to learn from industry experts. Seasoned professionals often share their experiences, strategies, and best practices during these events, providing attendees with valuable insights that can inform their investment decisions.

Moreover, property investment seminars often cover current market trends, regulatory changes, and emerging opportunities. Staying informed about the latest developments in Bethlehem’s real estate market is crucial for making informed investment choices, and seminars provide a platform for acquiring this knowledge.

Additionally, these events offer networking opportunities that can lead to valuable connections within the industry. Investors can meet fellow investors, real estate agents, and service providers, fostering relationships that can lead to future collaborations or partnerships.

Lastly, workshops often provide hands-on learning experiences, allowing investors to engage in practical exercises and case studies. This interactive approach can enhance understanding and retention of key concepts, equipping investors with the tools they need to navigate the property market confidently.

By actively participating in property investment seminars and workshops, investors can gain critical insights, expand their network, and enhance their overall investment strategies in Bethlehem.

How to Leverage Social Media for Real Estate Networking?

Utilising social media platforms for real estate networking can significantly enhance an investor’s reach and connections within Bethlehem’s property market. Social media provides a dynamic and versatile medium for engaging with other professionals, sharing insights, and staying informed about market developments.

Platforms like LinkedIn, Facebook, and Instagram allow investors to connect with industry peers, real estate agents, and potential partners. Joining real estate groups on these platforms can facilitate discussions, provide access to valuable resources, and enable investors to share experiences and knowledge.

Social media also serves as an excellent tool for staying updated on local market trends and news. Following relevant pages and influencers in the real estate sector can provide a steady stream of information, helping investors remain informed about emerging opportunities, regulatory changes, and industry best practices.

Moreover, showcasing personal investment successes or sharing informative content can enhance an investor’s credibility and visibility within the industry. This visibility can attract potential partners and clients, ultimately leading to fruitful collaborations.

Networking through social media allows for real-time engagement, making it easier to build rapport and establish connections. Engaging with others’ posts, commenting, and sharing relevant content fosters relationships and deepens connections with industry professionals.

By leveraging social media for real estate networking, investors can expand their reach, stay informed, and create valuable connections that can facilitate success in Bethlehem’s competitive property market.

Future Trends in Bethlehem’s Property Market

What Emerging Trends Should Investors Watch in Bethlehem’s Market?

Emerging trends in Bethlehem’s property market can provide valuable insights into future investment opportunities. Investors should be attuned to these trends to strategically position themselves for success.

One notable trend is the growing demand for affordable housing. As more individuals and families seek entry-level properties, there is a push for developers to create affordable housing options. This demand offers opportunities for investors to enter the market by purchasing properties that appeal to first-time buyers and renters.

Additionally, sustainability and eco-friendliness are becoming increasingly important in the property market. Many buyers are seeking energy-efficient homes and properties that incorporate green building practices. Investors who focus on properties that prioritise sustainability can tap into this growing market demand.

Furthermore, the rise of remote work has influenced housing preferences. With more individuals working from home, there is greater interest in properties that offer dedicated office spaces or proximity to recreational areas. Investors should consider these factors when evaluating properties and tailoring their offerings to meet changing buyer demands.

Finally, the ongoing development of infrastructure in Bethlehem, including roads, public transport, and amenities, is expected to continue driving property demand. Investors who stay informed about planned developments can identify areas poised for growth and potential appreciation.

By following these emerging trends, investors can strategically position themselves to take advantage of opportunities within Bethlehem’s evolving property market.

How to Identify Growth Areas in Bethlehem?

Predicting growth areas in Bethlehem requires careful analysis of various data points and trends. By identifying these areas, investors can target their investments to maximise returns.

One key factor to consider is infrastructure development. Areas slated for new transportation links, shopping centres, or schools are likely to experience increased demand for housing. Investors should monitor local government plans and community development initiatives to pinpoint these growth hotspots.

Population growth also serves as an essential indicator. Areas experiencing an influx of residents, particularly young professionals and families, tend to see rising property values. Tracking demographic trends and migration patterns can help investors identify neighbourhoods poised for growth.

Additionally, analysing local economic indicators, such as employment rates and job creation, can provide insights into potential growth areas. Regions with a stable job market and economic development typically attract new residents, driving demand for housing.

Investors should also consider evaluating historical price trends. Areas with consistent price appreciation over time are likely to continue this trend, making them attractive for investment.

Finally, engaging with local real estate experts can provide on-the-ground insights that may not be visible through data analysis alone. These professionals often have a pulse on the market and can help investors identify burgeoning areas with strong potential for growth.

By combining data analysis with expert insights, investors can effectively predict growth areas in Bethlehem, positioning themselves for success in the evolving property market.

What Long-Term Investment Strategies Are Effective in Bethlehem?

Developing long-term investment strategies tailored to Bethlehem’s market can maximise returns and ensure sustained success. Investors should consider several key strategies to enhance their property portfolios.

One effective strategy is to focus on buy-and-hold investments. Acquiring properties in stable or growing areas and holding onto them for the long term allows investors to benefit from appreciation and rental income. This approach is particularly effective in markets with steady demand, as properties appreciate over time.

Additionally, investors should consider diversifying their portfolios by investing in different types of properties, such as residential, commercial, or mixed-use developments. This diversification reduces risk and provides opportunities for multiple income streams.

Another critical strategy is to remain adaptable and responsive to market changes. Staying informed about local trends, economic indicators, and community developments enables investors to make timely adjustments to their portfolios, ensuring they capitalise on emerging opportunities.

Moreover, regularly assessing properties for potential upgrades or renovations can enhance value and rental income. By investing in improvements that align with current market demands, investors can maximise their returns.

Lastly, maintaining strong relationships with real estate professionals, contractors, and financial advisers can provide valuable insights and resources. This network can help investors navigate market changes and make informed decisions that align with their long-term investment goals.

By implementing these long-term investment strategies, investors can position themselves for continued success and maximised returns in Bethlehem’s dynamic property market.

How Do Infrastructure Developments Affect Bethlehem’s Property Market?

Infrastructure developments significantly influence Bethlehem’s property market, shaping demand and property values. Understanding these impacts is crucial for investors aiming to maximise their returns.

New infrastructure projects, such as transportation links and road upgrades, can enhance accessibility to various neighbourhoods. Improved transport options often lead to increased demand for housing as commuting becomes more convenient. Investors should keep an eye on upcoming projects to identify areas that may experience growth in property values.

Additionally, the development of amenities such as shopping centres, schools, and recreational facilities can enhance neighbourhood desirability. Properties located near these amenities typically see increased demand, driving up property prices. Investors should consider proximity to such developments when evaluating potential investments.

Moreover, infrastructure upgrades can lead to increased economic activity within a region. As businesses establish themselves in areas with improved infrastructure, job opportunities grow, attracting new residents. This influx can create a surge in housing demand, further impacting property values.

Investors should also be aware of potential zoning changes that may accompany infrastructure developments. Changes in land use regulations can create new opportunities for property development, influencing investment strategies.

By staying informed about infrastructure developments and their potential impacts, investors can strategically position themselves to take advantage of changes in Bethlehem’s property market, maximising their investment potential.

What Are the Effects of Regulatory Changes on Bethlehem’s Real Estate?

Regulatory changes can significantly affect Bethlehem’s real estate market, influencing property values, investment opportunities, and overall market dynamics. Understanding these changes is essential for investors aiming to navigate the complexities of the property landscape.

One key area of regulatory focus is zoning laws. Changes in zoning regulations can impact how properties can be used, potentially expanding or restricting development opportunities. Investors should stay informed about any upcoming changes that may affect their properties or investment plans.

Additionally, shifts in tax regulations can influence the overall cost of property ownership. Changes in property tax rates, transfer duties, or rental income taxes can impact an investor’s bottom line. Being aware of these changes allows for better financial planning and budgeting.

Moreover, regulatory changes related to tenant rights and rental laws can also affect property management strategies. Investors should understand their obligations and rights as landlords to ensure compliance and avoid potential legal issues.

Finally, government initiatives aimed at stimulating the housing market or promoting affordable housing can create new investment opportunities. These initiatives may include grants, subsidies, or changes in financing options that can benefit investors.

By remaining vigilant and informed about regulatory changes in Bethlehem, investors can adapt their strategies effectively, ensuring they remain compliant and optimise their investment potential in the evolving real estate landscape.

Frequently Asked Questions

What is the average property price in Bethlehem?

The average property price in Bethlehem varies significantly based on the area and property type. Generally, entry-level properties can range from R600,000 to R1,200,000.

How do I find the right property in Bethlehem?

To find the right property, research local listings, consult with real estate agents, and visit prospective neighbourhoods to assess amenities and conditions firsthand.

What are the best neighbourhoods for investment?

Promising neighbourhoods include Fichardt Park, Heidelberg, and Westonaria, known for their growth potential and affordability in the Bethlehem area.

How can I finance my property investment?

You can secure financing through traditional mortgages, private lenders, or government-backed loans tailored for first-time buyers and property investors.

What should I consider during property inspections?

Focus on structural integrity, plumbing, electrical systems, roof condition, and local amenities when assessing a property’s condition during inspections.

What are the common renovation costs in Bethlehem?

Renovation costs can vary widely, but budgeting between R50,000 to R200,000 for updates like kitchens, bathrooms, or exterior improvements is common.

Are there specific legal requirements when buying property?

Yes, ensure you understand title deeds, zoning laws, and municipal regulations, and engage a conveyancer to facilitate the transfer process.

What is the importance of market research?

Market research helps identify trends, assess property values, and uncover potential investment opportunities, ultimately guiding informed decision-making.

How do I calculate my return on investment?

ROI is calculated by dividing your net profit by the total investment cost, multiplying by 100 to express it as a percentage.

What are the benefits of networking in real estate?

Networking offers access to exclusive deals, industry insights, educational opportunities, and potential partnerships, enhancing overall investment success.