Top Affordable Neighborhoods in Mthatha for First-Timers

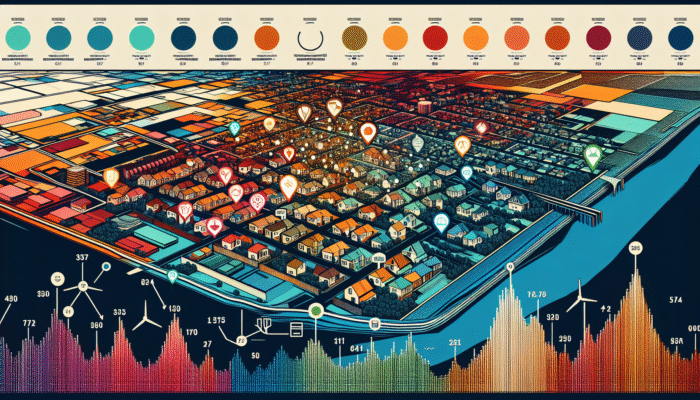

Exploring Affordable Housing Options in Mthatha

What Characteristics Define an Affordable Neighbourhood?

When evaluating the top affordable neighbourhoods for first-time buyers in Mthatha, a variety of crucial factors must be taken into account. One of the most significant aspects is the property prices, which need to align with the entry-level budgets common in South African urban environments. Moreover, the presence of local amenities greatly influences the appeal of a neighbourhood; easy access to schools, healthcare facilities, and shopping centres can significantly improve the attractiveness of a location. Additionally, efficient transport links add considerable value, facilitating easier commutes and broadening employment opportunities for residents.

First-time buyers should prioritise areas that strike a balance between affordability and quality of life. Neighbourhoods that boast well-maintained public spaces, recreational facilities, and a strong sense of community typically offer the most rewarding living experiences. These features not only contribute to a comfortable lifestyle but may also positively impact property values over time.

What Factors Impact Property Prices?

Gaining insight into the factors that influence property prices in Mthatha is vital for first-time buyers aiming to maximise their investment. Local economic indicators, including employment rates and income levels, are pivotal in shaping the property market. Furthermore, ongoing infrastructure developments, such as road enhancements and public transportation upgrades, can lead to increased property values in the long term. The availability of essential services and community facilities frequently results in heightened demand, which in turn can affect property pricing.

- Employment rates

- Average income levels

- Local infrastructure quality

- Proximity to essential services

- Community amenities

- Market demand fluctuations

- Investment in public spaces

By monitoring these indicators closely, first-time buyers can navigate the market landscape more effectively, identifying affordable homes that meet their preferences without compromising on essential community features.

What Common Challenges Do First-Time Buyers Face?

First-time buyers in Mthatha may face a number of prevalent challenges, one of which involves the unpredictability of market fluctuations. Property values can vary widely due to economic changes, creating a sense of uncertainty for newcomers. Additionally, a lack of familiarity with the local market may hinder first-time buyers from accurately assessing fair prices, potentially leading to overpayment.

Competition for affordable homes, especially in desirable locations, can also pose a significant challenge. Buyers need to be prepared to act swiftly and possess a clear understanding of their budget and financing options. Seeking guidance from seasoned real estate professionals can aid in navigating these hurdles effectively, empowering first-time buyers to make well-informed decisions.

Essential Considerations for First-Time Homebuyers

What Key Amenities Should You Seek?

In the quest for the best affordable neighbourhoods for first-time buyers in Mthatha, it is essential to focus on the fundamental amenities that contribute to a sustainable lifestyle. Neighbourhoods with reputable schools, supermarkets, healthcare facilities, and recreational areas greatly enhance day-to-day living. Schools are particularly vital for families, as they directly impact educational opportunities for children and the overall dynamics of the community.

Access to grocery stores and shopping centres allows residents to fulfil their daily needs without extensive travel. Furthermore, proximity to parks and recreational facilities supports a healthy lifestyle, providing spaces for outdoor activities and fostering community engagement. First-time buyers should prioritise neighbourhoods that offer a balanced mix of these vital amenities to ensure a fulfilling living experience.

How Can You Develop Effective Budgeting Strategies?

Establishing a robust budgeting strategy is essential for first-time buyers aiming to purchase a home in Mthatha. A crucial initial step involves assessing financial readiness, including savings, income, and current debts. This evaluation helps buyers understand their financial capabilities and determine what they can afford without overstretching their finances. Exploring various loan options available in South Africa, such as government subsidies for first-time buyers, can prove advantageous.

Creating a realistic budget should encompass not only the purchase price but also ancillary costs such as transfer duties, inspection fees, and ongoing maintenance expenses. First-time buyers ought to formulate a detailed budget that accounts for these factors, providing a clear overview of their total investment and ensuring financial stability as they transition into their new home.

What Should You Know About Long-Term Value Considerations?

Investing in property represents a long-term commitment, and first-time buyers in Mthatha should carefully evaluate the growth potential of their selected neighbourhoods. Areas demonstrating signs of community development, such as new educational institutions, shopping centres, or infrastructure enhancements, are likely to offer better resale prospects. Buyers should also keep an eye on future development plans for the area, as these can have a substantial impact on property values over time.

In addition to growth potential, first-time buyers should assess the overall community dynamics. Neighbourhoods with a strong community spirit and active local initiatives can contribute to stability and long-term satisfaction, making them more appealing for future resale. Understanding these elements will empower first-time buyers to make informed choices that align with their investment objectives.

What Makes a Neighbourhood Affordable?

How Do Property Prices Differ Across Various Areas?

Price disparities across different neighbourhoods in Mthatha can be quite pronounced, influencing the options available to first-time buyers. Comprehending these variations is crucial for making well-informed decisions regarding investment locations. Factors such as proximity to the city centre, access to public transport, and the quality of local amenities all play a role in determining price differences.

For example, areas situated closer to the city centre may command higher prices due to their convenience and accessibility, while outlying neighbourhoods might present more affordable housing options albeit with longer commute times. By comparing these elements, first-time buyers can pinpoint the most economical locations that align with their budget and lifestyle preferences.

What Are the Advantages of Choosing Emerging Neighbourhoods?

Emerging neighbourhoods in Mthatha offer distinct advantages for first-time buyers. One of the primary benefits is the lower entry costs associated with new developments. These areas frequently attract first-time buyers seeking affordability without sacrificing quality. Additionally, investing in an emerging neighbourhood can yield significant returns as the area continues to develop and mature.

Newly established neighbourhoods often feature modern amenities and updated infrastructure, enriching the living experience for residents. First-time buyers may also enjoy a strong sense of community, as these areas typically attract like-minded individuals who are keen to put down roots. By opting for emerging spots, buyers position themselves for future growth and potential increases in property values.

What Potential Drawbacks Should You Be Aware Of?

While affordable neighbourhoods in Mthatha may present enticing opportunities, there are potential drawbacks that first-time buyers should remain mindful of. One common concern is the necessity for ongoing maintenance, especially in older properties that may require renovations or upgrades. Buyers should conduct thorough property inspections to uncover any hidden issues that could lead to escalating costs in the future.

Another consideration is the surrounding environment, as some affordable areas may have less developed infrastructure or fewer amenities. It is essential for buyers to evaluate not only the property itself but also the community features that enhance quality of life. By identifying these potential drawbacks early in the process, first-time buyers can make decisions that align with their long-term aspirations and avoid unnecessary challenges.

Expert Insights on the Best Affordable Neighbourhoods in Mthatha for New Buyers

What Key Traits Should You Look For in Promising Areas?

Identifying promising neighbourhoods in Mthatha requires a careful assessment of specific traits that signal potential growth and livability. Successful areas often exhibit a strong community spirit, supported by active local organisations and initiatives. Furthermore, neighbourhoods featuring well-maintained public spaces and parks tend to attract families, fostering a sense of belonging among residents.

Accessibility is another significant trait to consider. Neighbourhoods with efficient transport links enhance commuting convenience, appealing to working professionals and families alike. First-time buyers should seek areas that demonstrate a balance of these attributes, as they often signify a stable environment conducive to long-term living.

Why Do These Neighbourhoods Stand Out?

What differentiates affordable options in Mthatha often lies in community aspects that resonate with South African property trends. Areas that prioritise social cohesion, such as local markets and community events, cultivate a sense of belonging that can enrich the living experience. These social dynamics frequently translate into improved property values over time.

Moreover, accessibility to essential services such as schools and healthcare facilities can elevate the desirability of certain neighbourhoods. First-time buyers should target locations that not only fulfil their immediate needs but also demonstrate potential for future growth. This foresight can significantly influence the success of their investment.

What Strategies Can You Employ for Secure Investments?

Making informed investments in Mthatha necessitates a strategic approach, especially for first-time buyers. One effective strategy involves conducting comprehensive research on local property trends, identifying which neighbourhoods are experiencing growth. Networking with local real estate professionals and attending property expos can yield valuable insights into emerging opportunities.

Additionally, first-time buyers should leverage technology to stay informed about market trends and property listings. Numerous online platforms offer tools to compare neighbourhoods and monitor price changes. By applying these strategies, buyers can position themselves to make informed, secure investments that align with their long-term objectives.

How Can You Evaluate Neighbourhoods for Home Buying?

What Inspection Steps Should You Take Before Buying?

Conducting a comprehensive inspection is vital when evaluating properties in Mthatha. First-time buyers should begin with an exhaustive walkthrough of the property, examining structural integrity, plumbing, and electrical systems. It is also prudent to assess the surrounding area, taking note of noise levels, safety, and community dynamics. Engaging a qualified home inspector can provide additional insights into the property’s condition and any potential issues that may arise.

Buyers should also consider the property’s age, as older homes may necessitate more maintenance or renovations. Understanding the unique characteristics of Mthatha’s housing stock can facilitate informed decision-making. By adhering to these inspection steps, first-time buyers can ensure they select a property that meets their needs and expectations.

What Signs Indicate a Good Community Fit?

Identifying indicators of a welcoming environment in Mthatha can significantly influence a first-time buyer’s satisfaction. Signs of a good community fit often include well-maintained public spaces, friendly neighbours, and active community engagement. Buyers should also look for evidence of local initiatives, such as community clean-up days or cultural events that foster connections among residents.

Furthermore, a good community fit may be reflected in the availability of local amenities, such as parks and recreational facilities, which encourage social interaction. First-time buyers should spend time in potential neighbourhoods to assess the atmosphere and determine if it aligns with their lifestyle and values.

What Aspects Are Often Overlooked During Selection?

When selecting a neighbourhood in Mthatha, various overlooked aspects can profoundly affect a buyer’s decision. Local services, including emergency response times, waste management efficiency, and public transport availability, can significantly impact everyday living. Buyers should also consider the future growth potential of the area, investigating upcoming developments or infrastructure projects.

- Emergency services proximity

- Public transport availability

- Waste management services

- Community facilities

- Future development plans

- Traffic patterns

- Noise levels

By scrutinising these hidden factors, first-time buyers will gain a more comprehensive understanding of their prospective neighbourhoods, informing their decisions and ensuring a sound investment.

Research-Backed Benefits of Top Affordable Neighbourhoods in Mthatha for First-Time Buyers

What Are the Advantages of Living Near Essential Services?

The benefits of residing close to essential services in Mthatha are numerous, particularly for first-time buyers. Being near schools, healthcare facilities, and shopping centres not only enhances convenience but also significantly impacts quality of life. For families, having schools nearby reduces commute times, allowing for better work-life balance and increased family time.

Moreover, easy access to healthcare services is vital for peace of mind, ensuring that residents can promptly attend to their health needs. Local shopping options enhance daily living by providing everything from groceries to essential services within a short distance. First-time buyers should prioritise neighbourhoods that offer these conveniences, as they contribute to overall satisfaction and long-term stability in their new home.

What Health and Lifestyle Perks Can You Expect?

Affordable neighbourhoods in Mthatha typically promote health and lifestyle benefits that are critical for first-time buyers. Areas with access to parks, walking trails, and recreational facilities encourage outdoor activities, fostering physical well-being. The presence of local health clubs and wellness centres also supports an active lifestyle, enhancing the overall living experience.

Furthermore, neighbourhoods that encourage social interaction through community events can have a positive effect on mental health, creating a supportive network for newcomers. Engaging in local activities and forming connections with neighbours contributes to a sense of belonging and community, which is essential for long-term satisfaction in a new home.

What Economic Growth Opportunities Exist?

Investing in affordable neighbourhoods in Mthatha offers first-time buyers substantial economic growth opportunities. Areas experiencing development tend to see property values rise over time, providing a solid return on investment. Additionally, neighbourhoods that attract businesses can create job opportunities for residents, thereby enhancing economic stability.

Buyers should research local economic indicators, such as employment rates and business growth, to pinpoint areas with the highest growth potential. By comprehending these dynamics, first-time buyers can strategically position themselves in the market, ensuring their investment pays off in the long run.

How Does Community and Social Integration Benefit Residents?

Affordable neighbourhoods in Mthatha play a crucial role in nurturing community bonds and support networks, which enhance overall life satisfaction for first-time buyers. Areas with active community organisations and social events foster interaction and engagement among residents, creating a strong sense of belonging.

Moreover, social integration can lead to increased resilience during challenging times, with neighbours supporting one another through various initiatives and activities. First-time buyers should seek neighbourhoods that emphasise community engagement, as these connections can greatly improve their overall experience and contribute to long-term happiness in their new home.

What Role Does Educational Access Play?

Proximity to quality educational institutions is a considerable advantage for first-time buyers in Mthatha. Areas with well-regarded schools offer families better educational access, fostering children’s development and future opportunities. This advantage can have lasting effects on property values, as families often seek out neighbourhoods that provide quality learning environments.

Furthermore, local educational initiatives that involve communities can create a supportive atmosphere, encouraging collaboration among families and schools. First-time buyers should take into account neighbourhoods that prioritise educational access and opportunities, as these factors can significantly enhance overall quality of life and contribute to long-term economic prospects.

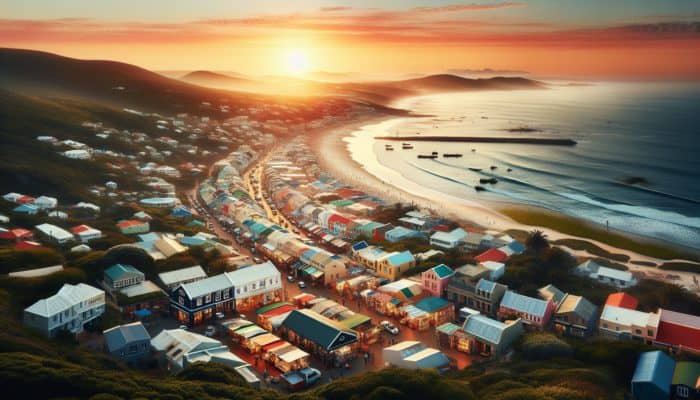

Why Is Mthatha a Prime Choice for Your First Home?

What Unique Features Make Mthatha Attractive to Buyers?

Mthatha boasts unique qualities that make it an appealing option for first-time buyers. The city is rich in cultural heritage, offering a sense of history and identity that attracts residents. Affordable property prices, coupled with a burgeoning economy, position Mthatha as an attractive choice for those looking to establish roots without incurring overwhelming financial strain.

Additionally, the city is renowned for its vibrant community spirit, with numerous local events and activities that foster connections among residents. This strong sense of community can significantly enhance the living experience, making Mthatha a desirable location for first-time buyers seeking more than merely a place to reside.

What Cultural and Social Attractions Does Mthatha Offer?

The cultural and social vibrancy of Mthatha is a major draw for first-time buyers. The city is celebrated for its annual events, art exhibitions, and traditional celebrations that highlight the region’s diverse culture. These community activities create opportunities for residents to engage and form meaningful connections, enriching their overall living experience.

Moreover, Mthatha’s social fabric combines modern amenities with traditional practices, resulting in a unique living environment. First-time buyers can appreciate the harmony between contemporary living and cultural heritage, making Mthatha a fulfilling place to call home.

What Are the Prospects for Future Development?

Upcoming projects in Mthatha promise to elevate property values and improve living standards for first-time buyers. Significant investments in local infrastructure, such as road upgrades, public transport expansions, and new commercial developments, are set to increase accessibility and draw more residents.

- New shopping centres

- Public transport upgrades

- Healthcare facility expansions

- Community recreational areas

- Educational institution developments

- Environmental beautification projects

These initiatives not only create a more attractive environment but also signify a commitment to community growth, making Mthatha an ideal location for first-time buyers seeking long-term investment potential.

How Important Is Access to Essential Services?

Reliable access to essential services is fundamental for first-time buyers in Mthatha. Proximity to healthcare facilities, schools, and utilities is critical for those looking to establish a stable foundation in their new home. Areas that offer easy access to these services ensure convenience and peace of mind, leading to a more satisfying living experience.

Furthermore, the availability of these services contributes to a sense of security and stability, which is especially important for families. First-time buyers should evaluate the quality and proximity of essential services when weighing their options, as these factors can greatly influence their overall satisfaction and long-term well-being in Mthatha.

Top Recommendations for Neighbourhoods in Mthatha

What Are the Most Popular Choices for New Buyers?

Certain neighbourhoods in Mthatha stand out as ideal choices for first-time buyers seeking affordability and accessibility. Areas like Umtata West offer a variety of affordable housing options with convenient access to schools and shops. Mthatha East is another popular choice, known for its family-friendly atmosphere and community parks that enrich the living experience.

Regions such as Umtata North and Umtata South also deliver excellent value, featuring a range of properties that fit various budgets. Each neighbourhood presents its unique charm and amenities, making them suitable for first-time buyers eager to find a home that meets their specific needs.

How Should You Prioritise Your Options?

Effectively ranking Mthatha’s neighbourhoods involves considering multiple factors that align with personal preferences and long-term objectives. Buyers should assess accessibility to essential services, the overall safety of each area, and community engagement when determining their priorities. Additionally, understanding the potential for future growth in each neighbourhood will assist buyers in making informed decisions.

First-time buyers should create a checklist of priorities that includes property prices, local amenities, and the overall community vibe. By systematically evaluating these elements, buyers can streamline their search and identify neighbourhoods that resonate with their lifestyles and aspirations.

How Can You Personalise Your Home Search?

Customising the home search process to individual needs is vital for first-time buyers in Mthatha. Each buyer possesses unique preferences and circumstances that should be considered when exploring potential neighbourhoods. Aspects like commute times, family size, lifestyle preferences, and budget constraints should guide evaluations of different areas.

Integrating personal needs into the search process not only saves time but also ensures that buyers discover a home that aligns with their values and aspirations. First-time buyers should collaborate closely with real estate professionals to pinpoint neighbourhoods that cater to their specific requirements, making the journey to homeownership as smooth and satisfying as possible.

Final Insights for First-Time Buyers

What Financing Options Should You Secure?

Securing the right financing is essential for first-time buyers looking to purchase properties in Mthatha. Understanding the various mortgage options and government assistance programmes can significantly alleviate financial burdens. Buyers should explore different lenders to compare interest rates and terms, ensuring they secure the most favourable conditions.

Additionally, first-time buyers should consider obtaining pre-approval for a mortgage, as this can expedite the buying process and enhance their negotiating power when making an offer. By being financially prepared, buyers can approach property purchases with confidence, knowing they have the necessary resources to make informed decisions.

What Common Mistakes Should You Avoid?

First-time buyers in Mthatha should be vigilant about potential pitfalls that can complicate the home-buying process. Common missteps include neglecting inspections, underestimating additional costs, and disregarding the importance of community dynamics. Failing to conduct comprehensive research can lead to regrettable choices that affect long-term satisfaction and financial stability.

To avoid these errors, first-time buyers should engage with experienced realtors and seek guidance from individuals familiar with local market dynamics. Taking the time to understand the nuances of the Mthatha property scene will empower buyers to make informed choices, securing their dream home without unnecessary stress.

How Can You Build a Support Network?

Establishing connections in Mthatha can greatly enhance the experience for first-time buyers. Building a support network with neighbours, local community members, and real estate professionals can provide valuable resources and guidance throughout the buying process. Engaging with local community groups can also facilitate friendships and deepen the sense of belonging.

Networking with other first-time buyers can lead to shared experiences and insights, assisting newcomers in navigating the challenges of homeownership. By fostering these connections, first-time buyers can create a supportive environment that not only aids in their transition to Mthatha but also enriches their overall living experience.

Frequently Asked Questions

What Should First-Time Buyers Consider When Looking for a Home in Mthatha?

First-time buyers should evaluate factors such as property prices, proximity to essential services, community amenities, and overall safety when seeking a home in Mthatha.

How Important Is It to Assess Local Amenities When Buying a Home?

Evaluating local amenities is crucial as they significantly affect daily living, convenience, and overall satisfaction in a neighbourhood.

What Financing Options Are Available for First-Time Buyers in Mthatha?

First-time buyers can explore various financing options, including government assistance programmes, bank loans, and mortgage products tailored to their needs.

How Can Buyers Effectively Evaluate Different Neighbourhoods?

Buyers can assess neighbourhoods by considering accessibility, community dynamics, amenities, and property values to determine the best fit for their lifestyle.

What Are the Common Challenges Faced by First-Time Homebuyers?

Common challenges include navigating market fluctuations, competition for properties, and limited knowledge of the local market, which can complicate decision-making.

How Can First-Time Buyers Avoid Mistakes During the Buying Process?

To prevent mistakes, first-time buyers should conduct thorough research, seek advice from real estate professionals, and carefully assess their financial readiness before making decisions.

Are There Emerging Neighbourhoods in Mthatha Worth Considering?

Yes, emerging neighbourhoods in Mthatha offer lower entry costs and the potential for future growth, making them appealing options for first-time buyers.

How Does Community Engagement Influence Property Values?

Communities with active engagement and a strong sense of belonging often attract more residents, resulting in increased property values over time.

What Are Some Essential Amenities to Look for in Mthatha?

Essential amenities include schools, healthcare facilities, grocery stores, and recreational areas, all of which contribute to a fulfilling living experience.

Why Is It Beneficial to Build a Support Network in Mthatha?

Creating a support network offers first-time buyers resources, advice, and a sense of community that can enhance their overall living experience and facilitate a smooth transition.