Top Budget-Friendly Areas for Ermelo First-Time Homebuyers

Comprehensive Analysis of Ermelo’s Vibrant Housing Market

Key Trends Shaping Ermelo’s Housing Market

The housing market in Ermelo has witnessed a surge in activity recently, becoming an enticing prospect for first-time buyers. The consistent rise in property prices signals an increasing demand for affordable homes, fundamentally transforming the market landscape. A few significant trends are evident:

- Heightened Demand for Affordable Homes: An influx of buyers, particularly first-time homebuyers, is actively seeking budget-friendly options.

- Stabilisation of Property Prices: While there is a noticeable upward trend in prices, the rate of increase has stabilised, allowing potential buyers to plan their budgets with greater accuracy.

- Migration Towards Suburban Living: Many buyers are favouring suburban regions surrounding Ermelo, where properties tend to be more spacious and affordable.

- Attraction for Property Investors: The market is drawing in investors keen on acquiring rental properties, leading to heightened competition among buyers.

These trends indicate a lively market where informed decision-making can lead to substantial advantages for first-time buyers eager to capitalise on emerging opportunities.

Diverse Property Types Available in Ermelo

Ermelo offers a rich array of housing options that cater to various needs and financial capacities. Understanding the different types of properties available empowers first-time buyers to make educated choices. The predominant types of properties include:

- Detached Houses: Generous homes accompanied by gardens, perfect for families seeking space.

- Semidetached Houses: A combination of affordability and space, often favoured by budget-conscious buyers.

- Townhouses: Providing a sense of community with minimal maintenance, ideal for young professionals.

- Flats and Apartments: These compact living spaces cater to singles and couples, offering essential amenities in close proximity.

Each property type presents unique advantages, and buyers should reflect on their long-term aspirations when selecting the right fit for their circumstances.

What Key Factors Affect Property Prices in Ermelo?

Several critical influences shape the property prices in Ermelo, which can aid buyers in pinpointing the best investment opportunities. The most significant determinant is location; properties situated nearer to the town centre and key services typically command higher prices. Furthermore, amenities such as schools, parks, and shopping centres heavily influence desirability and, consequently, property values.

In addition, economic growth plays a pivotal role. As Ermelo expands, new businesses and infrastructure initiatives create job opportunities and enhance the area’s attractiveness. By comprehending these factors, buyers can navigate the market more effectively and discover affordable options that align with their needs.

Expert Perspectives on Affordable Areas for First-Time Homebuyers in Ermelo

What Characteristics Define a Budget-Friendly Neighbourhood?

Budget-friendly neighbourhoods within Ermelo are characterised by lower property prices, excellent amenities, and significant growth potential. Such areas achieve a harmonious balance between affordability and quality of life, making them highly desirable for first-time buyers. For example, Central Ermelo features a diverse array of properties at accessible prices, all conveniently located near local amenities, while Dordrecht is known for its strong community atmosphere and well-kept public spaces.

Moreover, infrastructure investment by local authorities can further augment these areas, leading to appreciation in property values over time. First-time buyers should evaluate not just current prices, but also the future growth potential of neighbourhoods when making their assessments.

How to Assess the Potential of a Neighbourhood?

Evaluating a neighbourhood’s potential consists of several actionable steps that empower first-time buyers to make informed decisions. Begin by researching future development plans and community growth initiatives. Local councils often provide insights into upcoming projects that could positively affect property values.

Next, examine the local infrastructure, including public transport, schools, and healthcare facilities. A well-rounded neighbourhood typically has strong foundations for growth and sustainability. Here are some practical steps for evaluation:

- Visit the neighbourhood at various times to assess the activity and vibrancy.

- Engage with local residents to gain insights into community dynamics and available amenities.

- Investigate online listings and recent sales to analyse price trends.

- Inquire about planned infrastructure projects that could enhance the area.

Utilising these strategies can assist buyers in identifying neighbourhoods that resonate with their investment objectives.

What Long-Term Benefits Does Investing in Ermelo Offer?

Investing in property in Ermelo provides numerous long-term advantages for first-time buyers. One of the most significant benefits is the potential for property value appreciation. As the housing market continues to advance, buyers can expect their investments to appreciate over time.

Additionally, Ermelo fosters a strong community atmosphere, which is crucial for long-term satisfaction. Residing in a supportive neighbourhood cultivates a sense of belonging and encourages community involvement. Furthermore, there are opportunities for rental income; properties located in desirable areas can attract tenants, providing a steady revenue stream for owners.

In conclusion, investing in Ermelo transcends merely acquiring a home; it represents a pathway to building wealth and securing a stable future.

Which Neighbourhoods in Ermelo Are Most Affordable?

Identifying the most affordable neighbourhoods in Ermelo is essential for first-time homebuyers seeking value. A standout area is Witbank, renowned for its competitive property prices and family-friendly environment. Its proximity to essential services enhances its appeal, positioning it as a top choice for new buyers.

Another noteworthy neighbourhood is Fernridge, where spacious homes are available at reasonable prices, complemented by a welcoming community atmosphere. Buyers can expect various amenities, including parks and shopping destinations, catering to families and individuals alike.

Lastly, Kriel offers low-cost housing options, particularly attractive for those looking to enter the property market without excessive financial strain. Each of these neighbourhoods presents unique features that make them excellent options for first-time buyers.

How Can First-Time Buyers Successfully Navigate the Ermelo Housing Market?

Navigating the Ermelo housing market may seem overwhelming for first-time buyers, but with a strategic approach, the process can become manageable. Begin by establishing a realistic budget, which should encompass not only the property price but also additional expenses such as transfer fees and maintenance. Securing pre-approval for a mortgage can provide clarity regarding your financial capabilities and expedite the buying process.

Next, conduct thorough research on neighbourhoods that meet your criteria and visit potential properties to gauge the area. Working with a knowledgeable real estate agent can also significantly improve your experience; they can provide local insights and assist in negotiating the best price.

Here are essential steps to ensure a seamless buying journey:

- Establish a budget that includes all costs associated with purchasing a property.

- Obtain pre-approval for a mortgage to understand your financial limits.

- Research neighbourhoods and create a shortlist of potential properties.

- Engage a local real estate agent for expert guidance.

By following these steps, first-time buyers can navigate the market with confidence and ease.

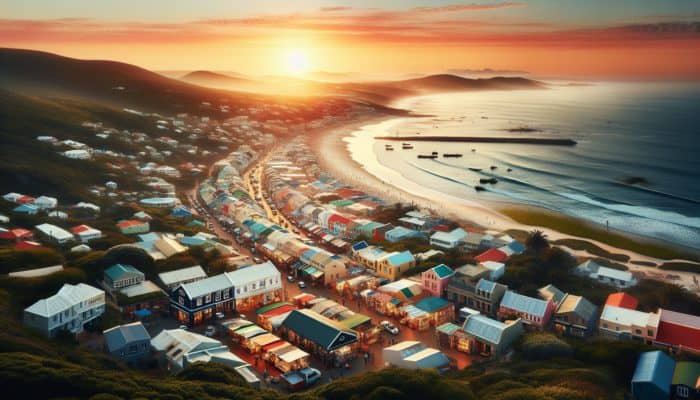

Outstanding Budget-Friendly Neighbourhoods in Ermelo

Neighbourhood A: Essential Attributes

Neighbourhood A, commonly known as Central Ermelo, excels in affordability and accessibility to vital services. This area is particularly appealing for first-time buyers seeking both value and convenience. Central Ermelo features a myriad of amenities, including grocery stores, healthcare facilities, and schools, all conveniently located within walking distance.

Moreover, the neighbourhood boasts excellent public transport connections, simplifying commuting for residents. A lively community spirit enriches the living experience, with local events and markets encouraging social interactions. Buyers can anticipate finding properties that deliver excellent value, making it an ideal location for those entering the property market for the first time.

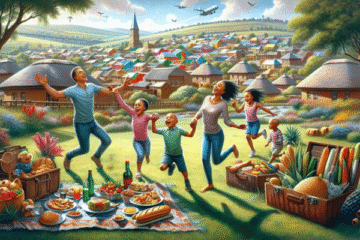

Neighbourhood B: Community Spirit and Lifestyle

Neighbourhood B, referred to as Dordrecht, is celebrated for its vibrant community and relaxed lifestyle. This area is perfect for first-time buyers in search of a welcoming environment that balances affordability with quality living. Dordrecht hosts a variety of community events, such as local fairs and cultural festivals, which help strengthen community ties and enhance the living experience.

The lifestyle in Dordrecht is characterised by a blend of outdoor activities and social gatherings, making it an attractive choice for families and young professionals alike. With ample parks, recreational facilities, and communal spaces, residents can enjoy a fulfilling lifestyle while benefiting from the affordability of housing in the area.

Neighbourhood C: Promising Future Development

Neighbourhood C, known as Kriel, stands on the brink of significant growth, making it a compelling option for both investors and first-time buyers. Planned development projects are set to enhance the area’s infrastructure and amenities, boosting its appeal and property values. Anticipated developments include new schools, shopping centres, and improvements to public transport, making Kriel particularly attractive for families.

The community has shown a positive attitude toward growth, with residents actively participating in initiatives aimed at making Kriel a desirable place to live. For first-time buyers, investing in Kriel now could yield substantial returns in the future as the area expands and property values rise.

Essential Steps for Navigating the Home Buying Process in Ermelo

What Actions Should First-Time Buyers Take?

First-time buyers in Ermelo can streamline the home buying process by adhering to a series of fundamental steps. Begin by setting a defined budget that includes all potential costs. Following this, obtaining pre-approval for a mortgage provides a clear understanding of your purchasing power.

Conduct thorough research on various neighbourhoods to identify those that match your criteria, and ensure to visit properties to evaluate their condition and suitability. Additionally, familiarise yourself with the home buying process to avoid any unforeseen challenges. Here’s a step-by-step guide to assist you:

- Establish a budget that includes all potential costs.

- Secure pre-approval for a mortgage to determine your financial limits.

- Research neighbourhoods to create a shortlist of suitable areas.

- Visit properties to assess their condition and location.

Following these steps will facilitate a successful navigation of the buying process.

Choosing the Ideal Real Estate Agent

Selecting the right real estate agent is a critical step in the home buying journey, particularly in Ermelo. A knowledgeable agent can significantly enhance the experience by offering insights into the local market and guiding you throughout the process. Prioritise finding agents with a strong local presence and positive reviews, indicating their effectiveness in assisting buyers.

To identify the best agents in Ermelo, consider seeking recommendations from friends, family, or colleagues who have recently purchased homes in the area. Additionally, leverage online platforms to research agents’ qualifications and track records. An agent who comprehends your needs and the local market can serve as an invaluable resource in your quest for the perfect home.

Understanding Essential Legal Requirements

Navigating the legal aspects of purchasing a home in Ermelo is crucial for ensuring a successful transaction. Key requirements include understanding property transfer duties, which are taxes imposed on the transfer of property ownership, as well as legal fees associated with hiring a conveyancer to facilitate the process.

First-time buyers should familiarise themselves with necessary legal documents, such as the sale agreement, which outlines the terms of the purchase, as well as any disclosures related to the property’s condition. By understanding these requirements upfront, buyers can ensure a smoother transaction and avoid potential legal complications.

Assessing and Making an Offer on a Property

Evaluating a property’s value in Ermelo before making an offer is a critical aspect of the buying process. Begin by comparing similar properties in the area to ascertain fair market value. Additionally, consider any unique features or conditions that may influence the property’s worth.

When ready to make an offer, ensure it accurately reflects the property’s value while remaining competitive within the current market. Approach the negotiation process thoughtfully, taking into account factors such as the seller’s motivation and prevailing demand levels. Understanding these elements positions you more favourably during negotiations and can lead to a positive outcome.

Financing Solutions for First-Time Homebuyers in Ermelo

What Mortgage Options Are Most Suitable?

For first-time buyers in Ermelo, comprehending the various mortgage options available is essential for securing the best deal. Generally, buyers can choose between fixed-rate mortgages and adjustable-rate mortgages. Fixed-rate mortgages provide stability with consistent payments throughout the loan term, while adjustable-rate mortgages may begin with lower rates that can fluctuate over time.

Additionally, there are government-backed loans specifically designed to assist first-time buyers, often featuring lower down payment requirements or more flexible qualification criteria. Each option has its benefits, and buyers should consider their long-term financial objectives when determining the most suitable mortgage type.

- Fixed-rate mortgages: Offer consistent payments throughout the loan duration.

- Adjustable-rate mortgages: Begin with lower rates but can vary over time.

- Government-backed loans: Assistance programmes with favourable terms for first-time buyers.

- Conventional loans: Traditional loans with specific eligibility criteria.

A good understanding of these mortgage options empowers buyers to make informed decisions.

Government Assistance Initiatives for First-Time Buyers

A range of government assistance programmes is available to support first-time buyers in Ermelo, making homeownership more attainable. These programmes often encompass grants, low-interest loans, or down payment assistance that can significantly alleviate initial financial pressures.

The First Home Finance Scheme is an example of an initiative designed to assist first-time buyers by providing financial support for purchasing homes within specific price thresholds. Furthermore, various local initiatives may also offer incentives for buyers committed to residing in designated areas or contributing to community development.

By exploring these programmes, first-time buyers can uncover opportunities that enhance their ability to secure a home in Ermelo.

How to Enhance Your Credit Score?

A healthy credit score is essential for first-time buyers aiming to secure a mortgage, as it directly influences the interest rates and loan terms available. Buyers in Ermelo can take proactive steps to elevate their credit scores swiftly. Start by ensuring that all bills are paid punctually, as late payments can have a detrimental effect on your score.

Next, work to reduce any outstanding debts, which can improve your credit utilisation ratio—the amount of credit being utilised compared to the total available credit. Regularly reviewing your credit report for inaccuracies and disputing any errors can also have a positive impact on your score.

Here are practical strategies to improve your credit score:

- Pay bills on time to avoid late fees and negative reporting.

- Reduce existing debts to enhance your credit utilisation ratio.

- Review your credit report for inaccuracies and dispute them.

- Limit new credit applications to avoid hard inquiries.

Implementing these strategies can facilitate better financing options for buyers.

Down Payment Assistance Programmes

Down payment assistance programmes are invaluable resources for first-time buyers in Ermelo, alleviating the initial financial burden of purchasing a home. These programmes may manifest as grants or low-interest loans specifically designed to cover down payments, which is often the most formidable obstacle for new buyers.

Local government initiatives, along with non-profit organisations, frequently offer such assistance. For example, some programmes may provide matched savings accounts, where contributions are matched by the programme to support buyers in saving for a down payment.

Understanding the available options and eligibility requirements is crucial for first-time buyers looking to benefit from these supportive programmes.

Effective Budgeting for Homeownership

Sound budgeting is vital for first-time buyers in Ermelo, ensuring they can manage all costs associated with homeownership. It is essential to consider not only the mortgage payment but also additional expenses such as property taxes, insurance, maintenance, and utilities.

Creating a comprehensive budget that accounts for these recurring expenses can help prevent financial strain. Buyers should also allocate funds for unexpected repairs or emergencies, which are an inevitable component of homeownership.

Here are critical budgeting tips to consider:

- Calculate total monthly mortgage payments, including principal and interest.

- Incorporate property taxes and homeowners insurance into your budget.

- Reserve funds for ongoing maintenance and repairs.

- Establish an emergency fund for unforeseen expenses.

By adopting a detailed budgeting approach, first-time buyers can navigate homeownership with confidence and security.

Research-Driven Benefits of Top Budget-Friendly Areas for First-Time Homebuyers in Ermelo

What Are the Economic Benefits of Investing in These Areas?

Investing in budget-friendly areas of Ermelo presents numerous economic advantages, particularly lower living costs and the potential for property value appreciation. Reduced property prices enable first-time buyers to enter the market at a more manageable level, allowing them to allocate funds to other areas, such as savings or future investments.

Additionally, these areas frequently experience economic growth as more buyers move in, resulting in increased demand and, ultimately, higher property values. A pertinent example is Kriel, where ongoing development projects are anticipated to significantly elevate living standards and property prices in the coming years.

Understanding these economic benefits can guide buyers in making informed decisions that align with their financial objectives.

How Do These Areas Enhance Quality of Life?

Living in budget-friendly neighbourhoods within Ermelo can significantly enrich overall quality of life. These areas typically offer convenient access to amenities such as schools, parks, and healthcare services, which are essential for families and individuals alike.

Moreover, the community engagement characteristic of these neighbourhoods fosters a supportive environment, where residents participate in local events and initiatives. This sense of belonging can greatly enhance personal well-being and satisfaction.

To assess quality of life in these areas, consider visiting during community events or engaging with local residents to gain insights into their experiences and perspectives.

What Social Benefits Are Associated with These Neighbourhoods?

Budget-friendly neighbourhoods in Ermelo tend to foster strong community ties and social engagement. The lower cost of living allows for a diverse range of residents, creating a rich tapestry of cultural backgrounds and experiences. This diversity enhances community dynamics and contributes to a more vibrant social fabric.

Social benefits extend beyond mere affordability; they encompass the supportive networks that emerge within these communities. Residents often come together to participate in local initiatives, volunteer projects, and social gatherings, forging connections that can lead to lifelong friendships and valuable networks.

An analysis of these social benefits reveals that first-time buyers not only gain a home but also enter a community that offers mutual support and engagement.

What Support Is Available for First-Time Buyers in These Areas?

Budget-friendly neighbourhoods in Ermelo facilitate homeownership for first-time buyers by providing easier entry points into the market. With lower property prices, buyers can secure homes that align with their financial capabilities, thereby reducing the barriers to homeownership.

Moreover, many of these areas offer access to government assistance programmes and financing options tailored specifically for first-time buyers, further easing the transition into homeownership. The supportive community environment also plays a significant role, as first-time buyers often receive guidance and assistance from more experienced homeowners.

By understanding how these areas support new buyers, potential homeowners can feel more confident in their investment decisions.

What Are the Long-Term Investment Prospects in These Areas?

Investing in budget-friendly neighbourhoods of Ermelo presents promising long-term returns for first-time buyers. As demand for housing continues to rise, particularly in emerging neighbourhoods, buyers can anticipate their properties appreciating in value over time.

Furthermore, these areas provide opportunities for generating rental income, making them appealing for investors looking to diversify their portfolios. With a growing population and increasing economic activity, the potential for robust returns on investment remains high.

Data-driven insights indicate that properties in these areas are likely to experience substantial appreciation, rendering them a wise choice for long-term investment.

Essential Tips for Successful Homeownership in Ermelo

What Key Maintenance Tasks Should You Prioritise?

First-time buyers in Ermelo should prioritise home maintenance to preserve property value and ensure a comfortable living environment. Conducting regular inspections is crucial, particularly for key areas such as the roof, plumbing, and electrical systems.

Addressing repairs promptly can prevent minor issues from escalating into costly problems. Additionally, maintaining the exterior of the home, including landscaping and paintwork, contributes to curb appeal and overall community aesthetics.

Key maintenance tasks to focus on include:

- Conduct regular inspections of the roof and gutters to prevent leaks.

- Check plumbing for leaks and ensure proper drainage.

- Maintain heating and cooling systems for optimal efficiency.

- Regularly inspect the exterior for signs of wear and tear.

By prioritising these maintenance tasks, first-time buyers can protect their investment and enhance their enjoyment of their homes.

How to Build Equity in Your Home?

Building equity in a home is a vital component of homeownership that can significantly increase personal wealth over time. First-time buyers in Ermelo can build equity by making consistent mortgage payments, which decrease the principal balance owed on the home.

Additionally, investing in home improvements can enhance property value and, in turn, equity. Staying informed about market trends and neighbourhood dynamics is equally important; as property values rise, so does the equity in your home.

Effective strategies to build equity include:

- Make larger payments on the mortgage to reduce the principal faster.

- Invest in renovations that add value to the property.

- Stay informed about market trends that affect property values.

- Consider renting out a portion of the home to increase income and offset mortgage costs.

Implementing these strategies enables first-time buyers to steadily build equity in their properties.

Community Engagement and Networking Opportunities

Participating in community activities and networking with neighbours can significantly enhance the homeownership experience in Ermelo. Not only does it foster a sense of belonging, but it can also lead to valuable connections and support systems.

Engaging in local events, such as fairs, workshops, or volunteer opportunities, provides avenues for meeting fellow residents and strengthening community ties. Additionally, joining local clubs or groups that resonate with personal interests can broaden social circles and enhance overall quality of life.

Ways to become involved in the community include:

- Attend local events and festivals to connect with neighbours.

- Participate in community service projects to make a positive contribution.

- Join local interest groups or clubs to meet like-minded individuals.

- Engage with community boards or online groups to stay updated.

Active community involvement can enrich the homeownership experience and cultivate a supportive living environment.

Frequently Asked Questions

What is the average property price for first-time buyers in Ermelo?

The average property price for first-time buyers in Ermelo typically ranges from R700,000 to R1,200,000, depending on the neighbourhood and type of property.

Are there government assistance programmes for first-time buyers in Ermelo?

Yes, numerous government assistance programmes are available for first-time buyers in Ermelo, including grants and loans designed to assist with down payments.

What types of properties are available for first-time buyers in Ermelo?

First-time buyers in Ermelo can find a variety of properties, including detached houses, semidetached homes, townhouses, and flats.

How can I improve my credit score before purchasing a home?

To enhance your credit score, ensure bills are paid on time, reduce existing debt, check your credit report for inaccuracies, and limit new credit applications.

What factors should I consider when selecting a neighbourhood in Ermelo?

Consider aspects such as proximity to amenities, community engagement, the potential for property value appreciation, and overall quality of life.

How do I evaluate a neighbourhood’s potential?

Evaluate a neighbourhood’s potential by researching future development plans, assessing current amenities, and engaging with local residents to understand community dynamics.

Which neighbourhoods in Ermelo are the most affordable?

Some of the most affordable neighbourhoods in Ermelo include Central Ermelo, Dordrecht, and Kriel, each offering unique advantages for first-time buyers.

What are the key steps in the home buying process?

Key steps in the home buying process include establishing a budget, obtaining pre-approval for a mortgage, researching neighbourhoods, visiting properties, and understanding legal requirements.

How can I budget effectively for homeownership?

Budget effectively by accounting for all costs associated with homeownership, such as mortgage payments, property taxes, insurance, and maintenance expenses.

What long-term benefits can I expect from investing in Ermelo’s housing market?

Long-term benefits of investing in Ermelo include property value appreciation, opportunities for rental income, and becoming part of a thriving community.