First-Time Buyer Mistakes to Avoid in Ladysmith

Avoiding Common Pitfalls in Property Selection

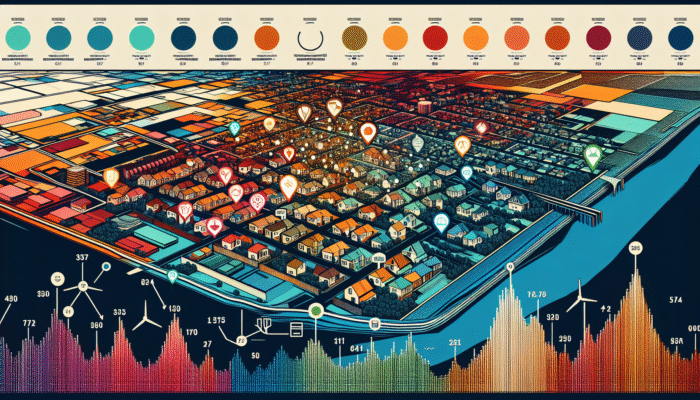

Recognising the Importance of Location

In Ladysmith, South Africa, many first-time buyers make the critical error of disregarding vital location factors that profoundly influence both lifestyle and property value. The convenience of being close to essential amenities, such as schools, hospitals, shops, and public transport, can greatly enhance daily living and future resale prospects. Additionally, potential buyers frequently overlook local crime rates, which can have significant implications for both safety and property prices. When assessing potential neighbourhoods in Ladysmith, it is important to consider these crucial elements:

- Accessibility to public transport and major roads.

- Proximity to schools, healthcare, and shopping centres.

- Local crime statistics and safety ratings.

- Community amenities such as parks and recreational facilities.

- Future development plans that may affect property values.

- Environmental factors, including flood zones or noise pollution.

- Community reputation and neighbour relations.

- Local economic stability and job opportunities.

Having a comprehensive understanding of these aspects will empower buyers to make informed decisions that align with their long-term needs and investment objectives. The characteristics of a neighbourhood can dictate not only the quality of life but also the potential appreciation of the property over time.

The Crucial Role of Property Inspections

First-time buyers in Ladysmith often underestimate the importance of conducting thorough property inspections, which can have severe consequences if neglected. By skipping inspections, buyers risk missing critical issues such as structural damage, plumbing failures, or outdated electrical systems, all of which could result in substantial repair costs post-purchase. In South Africa, adhering to local building standards is paramount for ensuring safety and compliance.

Investing in a professional inspection by a certified property inspector is a prudent step in the buying process. These experts can pinpoint concealed defects and evaluate the property’s overall condition, providing buyers with invaluable insights. Common checks that prospective buyers often overlook include:

- Roof integrity, especially in Ladysmith’s variable weather.

- Foundation stability and potential cracks.

- Plumbing systems for leaks or outdated installations.

- Electrical wiring and compliance with safety standards.

- Pest infestations, particularly in older homes.

- Heating and cooling systems efficiency.

- Water drainage systems and potential flood risks.

- Compliance with local zoning regulations.

Addressing these concerns early can spare buyers from financial burdens and emotional distress. A detailed inspection report provides buyers with the knowledge necessary to negotiate repairs, adjust prices, or even reconsider the purchase entirely.

What Consequences Arise from Ignoring Budgeting?

In Ladysmith, first-time buyers frequently misjudge the total costs associated with purchasing property, which can lead to financial strain and anxiety. Proper budgeting is vital to prevent unexpected expenses that could derail the buying process. Many buyers focus solely on the property’s purchase price, neglecting additional costs such as transfer duties, conveyancing fees, and other related expenses.

To facilitate a smoother buying experience, buyers must account for all potential costs, including but not limited to:

- Transfer duty fees, which can vary depending on the property value.

- Conveyancing fees for legal services during the transfer.

- Homeowners insurance and other mandatory insurances.

- Maintenance costs for repairs and upkeep.

- Utility connection fees and initial deposits.

- Moving costs and related expenses.

- Potential renovations or improvements post-purchase.

- Property taxes and monthly rates.

By preparing a comprehensive budget that encompasses these factors, buyers can circumvent unpleasant surprises during the purchase process. This financial foresight not only facilitates a smoother transaction but also ensures long-term sustainability in property ownership.

How Emotional Factors Can Cloud Judgement in Property Buying?

In the property buying process, especially in Ladysmith, South Africa, emotional influences can obscure judgment and lead to misguided decision-making. Numerous first-time buyers become enamoured with a property’s aesthetics or charm, failing to adequately assess its practical aspects. This emotional attachment can result in regret when the realities of the home’s functionality or suitability become apparent.

To mitigate this prevalent issue, buyers should prioritise objective criteria while also seeking professional advice. The significance of a systematic approach cannot be overstated:

- Establish a clear list of must-haves and deal-breakers before viewing properties.

- Engage with a reputable estate agent who understands the local market and can provide rational insights.

- Consider the long-term implications of the property choice, such as resale value and maintenance costs.

- Involve family or friends in discussions, as external perspectives can offer valuable clarity.

- Take time to reflect on the decision rather than making impulsive choices during viewings.

- Assess the property’s alignment with personal and financial goals.

- Utilise checklists to objectively compare potential properties.

- Seek out reviews or testimonials from previous buyers in the area.

By focusing on objective criteria and being mindful of emotional influences, buyers can make wiser decisions that align with their long-term goals, thereby avoiding feelings of regret.

Evaluating Property Values: Essential Strategies

What Influential Factors Determine Property Values?

Understanding the key factors that influence property values is crucial for first-time buyers in Ladysmith. Local market trends, property condition, and location all significantly determine a property’s worth. Buyers must carefully assess these elements to avoid overpaying for their investment.

Local market trends in Ladysmith can fluctuate based on various influences, including economic conditions, population growth, and demand for housing. Buyers should consider:

- Current market conditions, whether it’s a buyer’s or seller’s market.

- Comparative sales analysis to determine fair market value.

- Future development plans or infrastructure projects that could affect property values.

- Local economic indicators, such as employment rates and income levels.

- Property condition, including upgrades or renovations that add value.

- Neighbourhood demographics and their impact on desirability.

- Seasonal trends affecting housing demand.

- Historical value appreciation rates in the area.

By evaluating these factors, buyers can make informed decisions that reflect the true value of properties. Conducting thorough research will empower buyers to negotiate better deals and secure properties that genuinely meet their needs.

Staying Informed About Local Market Trends

For buyers in Ladysmith, failing to remain informed about local market trends can lead to poor decision-making regarding property purchases. Market trends, such as fluctuations in demand for suburban versus urban properties, significantly influence property values and potential investment returns. Understanding these dynamics can help buyers negotiate more effectively and avoid inflated purchases.

Monitoring local market trends involves assessing:

- Current demand levels in different areas of Ladysmith.

- Price fluctuations over time and their correlation with economic factors.

- Average days on the market for properties in various neighbourhoods.

- Buyer preferences shifting between types of properties (e.g., apartments vs. family homes).

- Availability of stock and its impact on competition.

- Seasonal trends that may affect listings and sales.

- Local developments, such as new schools or shopping centres, that enhance desirability.

- Feedback from real estate agents regarding potential shifts in the market.

Being proactive in understanding these trends equips buyers with the information necessary to make informed offers, thereby avoiding overpayment in a competitive market.

Conducting a Comprehensive Assessment of Property Condition

In Ladysmith, first-time buyers often overlook the condition of the properties they are considering. The climate can impose unique challenges, such as wear and tear from storms or heat, making it vital to assess properties thoroughly. Neglecting to evaluate a home’s condition can lead to unanticipated costs and dissatisfaction with the investment.

Buyers should be vigilant in checking for signs of wear and tear, including:

- Roof damage or missing shingles, particularly after severe weather.

- Cracks in walls or foundations, which may indicate structural issues.

- Signs of dampness or water damage, especially in basements.

- Condition of windows and doors for proper sealing and functionality.

- Overall cleanliness and maintenance levels of the property.

- Quality of fixtures and fittings, which may need replacement.

- Landscaping and outdoor conditions that may require attention.

- Potential electrical hazards, especially in older homes.

A thorough assessment will facilitate better negotiating power and ensure that buyers are aware of what they commit to financially and practically. Engaging a qualified inspector can further safeguard their investment by identifying hidden defects that may not be visible at first glance.

Expert Insights on Avoiding First-Time Buyer Mistakes in Ladysmith

Real-World Examples of Common Errors

Real-world examples often illuminate the pitfalls first-time buyers encounter in Ladysmith. A frequent error includes neglecting local zoning laws, which can lead to regrettable decisions down the line. For instance, a buyer might fall in love with a property only to discover that intended renovations or business operations are not permissible under current zoning regulations.

To avoid such oversights, buyers should:

- Research local zoning laws and restrictions specific to the property.

- Consult with the local municipality regarding potential uses for the property.

- Engage real estate professionals familiar with local regulations.

- Attend community meetings for insights on future developments.

- Understand the implications of zoning on property value and future plans.

- Review any existing encumbrances or easements on the property.

- Assess how zoning impacts neighbourhood dynamics.

- Seek legal advice to clarify complex zoning issues.

By learning from local case studies and consulting experts, buyers can navigate the complexities of property selection in Ladysmith, ensuring that their investments align with their long-term goals.

Expert Analysis of Financial Pitfalls

Misjudging affordability is a dangerous trap for first-time buyers in Ladysmith. Many are drawn to properties above their means, underestimating the long-term financial implications. For example, a buyer may qualify for a mortgage but overlook how monthly repayments, including interest, can strain their budget.

To avoid financial pitfalls, potential buyers should:

- Calculate total monthly housing costs before making offers.

- Factor in fluctuating interest rates and their impact on repayments.

- Assess personal budgets to determine realistic spending limits.

- Investigate different financing options and their long-term implications.

- Consider the costs of homeownership beyond mortgage payments.

- Engage financial advisors for tailored budgeting strategies.

- Examine long-term financial goals and how property fits into them.

- Utilise mortgage calculators to get a clearer picture of potential costs.

A comprehensive understanding of financial responsibilities will empower buyers to make informed choices and avoid falling into debt traps, ensuring a more secure financial future.

Actionable Steps for Making Informed Location Choices

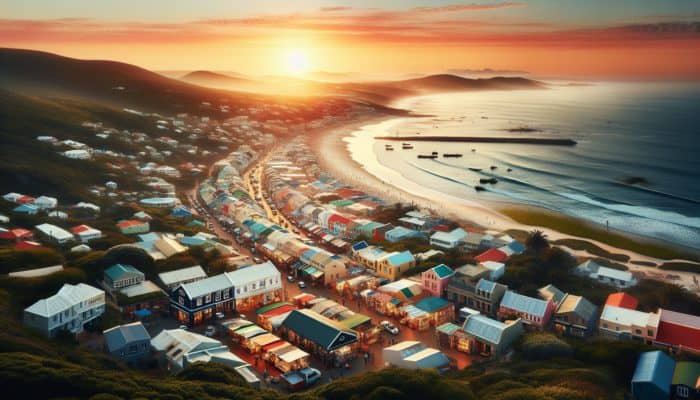

When making location choices in Ladysmith, first-time buyers should take a strategic approach. Successful purchases often hinge on thorough research into local infrastructure and amenities. An example includes a buyer who secured a home near the town centre, enjoying easy access to schools and shops, which later contributed to a higher property value.

To identify optimal locations, buyers should:

- Conduct thorough research of neighbourhoods and their amenities.

- Visit potential areas at different times of the day to gauge activity levels.

- Engage with local residents for insights on community atmosphere.

- Inspect the availability of essential services like hospitals and schools.

- Assess transportation options, including proximity to main roads and public transport.

- Evaluate crime rates and community safety through local reports.

- Consider future developments that may enhance property value.

- Utilise real estate platforms to compare neighbourhood statistics.

These actionable steps can empower buyers to make wise choices that meet their lifestyle needs while positioning them for future growth in property value.

Expert Guidance on Avoiding Legal Pitfalls in Property Purchases

In Ladysmith, first-time buyers often neglect essential legal checks, such as verifying title deeds, which can lead to ownership disputes. A lack of due diligence can result in significant legal complications after the purchase, leaving buyers vulnerable to claims by third parties. For instance, a buyer may find themselves embroiled in a dispute over property boundaries due to insufficient verification of documentation.

To avoid such pitfalls, buyers should:

- Engage a competent conveyancer to handle legal aspects of the transaction.

- Request a full title deed search to confirm ownership and encumbrances.

- Review property boundaries with professional surveys if necessary.

- Understand local laws regarding property acquisition and ownership.

- Check for any existing liens or disputes attached to the property.

- Ensure compliance with local zoning laws to avoid future issues.

- Maintain copies of all legal documents for reference.

- Consider investing in title insurance to provide added protection.

Expert guidance on these legal matters will facilitate a smoother transaction and safeguard buyers against potential ownership disputes, ensuring peace of mind in their investment.

What Financing Options Are Available for First-Time Buyers?

How to Successfully Secure a Mortgage?

Securing a mortgage in Ladysmith requires a clear understanding of the bank’s requirements, including interest rates and eligibility criteria. First-time buyers should be prepared to present necessary documentation to facilitate the application process and enhance their chances of approval.

Steps to successfully secure a mortgage include:

- Assessing personal credit scores and addressing any issues beforehand.

- Gathering required documentation, including proof of income and identification.

- Researching various banks and financial institutions for the best rates.

- Consulting with mortgage brokers for tailored advice and options.

- Understanding the differences between fixed and variable interest rates.

- Considering pre-approval to strengthen negotiating power when making offers.

- Evaluating the total cost of borrowing, including fees and insurance.

- Staying informed about changes in mortgage regulations that could impact eligibility.

By taking these proactive steps, buyers can navigate the mortgage landscape more effectively, ensuring they secure financing that aligns with their financial goals.

Grasping the Impact of Interest Rates on Mortgages

First-time buyers in Ladysmith often struggle to grasp how interest rates impact their mortgage repayments. Understanding the different types of rates and their implications is crucial for making informed financing decisions. Interest rates can vary widely depending on market conditions and individual borrower profiles.

To aid in selecting the best financing option, buyers should consider the following key rate types:

- Fixed interest rates, providing stability over the duration of the mortgage.

- Variable interest rates, which may fluctuate and affect monthly payments.

- Prime rates set by banks, influencing mortgage offerings.

- Discounted rates that may apply for a limited time.

- Effective interest rates which account for all costs involved in borrowing.

- Comparison rates that give a broader picture of the mortgage’s true cost.

- Rates associated with different loan terms and their impact on repayments.

- Potential rate changes due to market conditions or borrower actions.

By familiarising themselves with these aspects, buyers can make strategic decisions regarding their financing, ultimately leading to better long-term financial health.

Anticipating Hidden Fees in Property Purchases

In Ladysmith, overlooking hidden fees associated with property purchases can place significant strain on finances. First-time buyers often focus solely on the property price, neglecting additional costs that can accumulate and disrupt budgeting plans. Being aware of these fees is crucial for ensuring a successful buying experience.

Essential fees buyers should budget for include:

- Transfer duty, which is calculated based on the property’s purchase price.

- Conveyancing fees for legal services related to property transfer.

- Homeowners insurance, which protects against potential losses.

- Utility connection fees for electricity, water, and internet services.

- Inspection costs for property assessments.

- Renovation costs for any immediate repairs or upgrades needed.

- Moving costs and related expenses.

- Property taxes that will accrue after the purchase.

By accounting for these hidden fees in their financial plans, buyers can avoid budget overruns and ensure a smoother transition into homeownership. This level of preparedness allows for more accurate financial forecasting and contributes to a positive purchasing experience.

Effective Strategies for First-Time Buyer Success in Ladysmith

Real-World Examples from South African Markets

Focusing on real-world examples from Ladysmith highlights the importance of thorough legal checks. Many first-time buyers have skipped these vital steps, leading to issues such as unclear titles and subsequent disputes. For instance, a recent case involved a buyer who discovered unresolved boundary disputes after the purchase, leading to costly legal battles.

To verify titles and avoid disputes, buyers should:

- Conduct comprehensive title searches through the local deeds office.

- Request necessary documentation from the seller regarding property ownership.

- Engage professionals to interpret complex legal documents.

- Understand the implications of any existing encumbrances.

- Verify any easements or rights of way that may affect the property.

- Consult with local conveyancers for legal guidance.

- Attend community meetings to gain insights on property issues.

- Invest in title insurance for added protection against disputes.

Implementing these strategies, informed by local experiences, will help buyers navigate the complexities of property ownership more effectively and safeguard their investments.

Actionable Steps for Successful Negotiation

Effective negotiation is a critical skill for first-time buyers in Ladysmith, allowing them to secure better terms on their property purchases. Researching comparable sales in the area is an essential step in making informed offers. Buyers can leverage this information to negotiate effectively and avoid overpayment.

Actionable steps for successful negotiation include:

- Researching recent sales in the neighbourhood to establish a fair price range.

- Gathering data on market trends to bolster negotiating positions.

- Identifying seller motivations that may provide leverage.

- Being prepared to walk away if terms are unsatisfactory.

- Engaging estate agents for expertise and insight during negotiations.

- Utilising written offers to create clarity and formality in discussions.

- Considering contingencies that may make offers more appealing to sellers.

- Practising negotiation techniques to enhance confidence and effectiveness.

By adopting these strategies, buyers can enter negotiations well-prepared, increasing their chances of achieving favourable outcomes in their property transactions.

Highlighting the Importance of Thorough Inspection Processes

Highlighting real-world examples from Ladysmith demonstrates the importance of thorough property inspections. Many buyers have uncovered significant issues during inspections that could have led to costly repairs had they not been identified early. For instance, a recent case involved a buyer who discovered severe roof damage that prompted a price reduction before proceeding with the purchase.

Effective property inspections should include:

- Hiring qualified professionals to conduct comprehensive assessments.

- Requesting detailed inspection reports that outline findings.

- Being present during inspections to ask questions and gain insights.

- Reviewing all structural components, including foundations and roofing.

- Assessing internal systems like plumbing and electrical for compliance.

- Checking for indications of pest infestations that could affect the property.

- Involving family or advisors in the inspection process for additional perspectives.

- Utilising checklists to ensure comprehensive coverage of potential issues.

By prioritising thorough inspections and learning from local examples, buyers can make informed decisions and avoid the pitfalls associated with undiscovered property issues.

The Importance of Legal Checks in Property Transactions

Which Documents Should Buyers Verify?

In Ladysmith, failing to check essential documents can lead to significant legal complications for property buyers. It’s crucial to verify deeds and bonds to safeguard against future ownership disputes or financial liabilities. Understanding which documents to review is key to ensuring a smooth property acquisition process.

Essential documents buyers must verify include:

- Title deeds that clearly establish ownership and property boundaries.

- Bond documents to confirm any existing loans against the property.

- Zoning certificates that clarify permissible property uses.

- Compliance certificates for electrical and plumbing systems.

- Land survey documents detailing property dimensions and encroachments.

- Property tax statements to confirm tax history and liabilities.

- Homeowners association agreements if applicable.

- Disclosure documents outlining known property issues or repairs.

By meticulously reviewing these documents, buyers can mitigate legal risks and ensure that their property purchase aligns with their investment goals, fostering a sense of security in their decision-making process.

Preventing Common Title Disputes

Common title disputes can create substantial headaches for property buyers in Ladysmith. Many buyers neglect vital title searches, leading to ownership conflicts that can arise from various legal issues. Understanding the significance of conducting thorough title investigations is essential for safeguarding investments.

To avoid these disputes, buyers should:

- Engage professionals to conduct comprehensive title searches.

- Verify the history of the property’s ownership for any discrepancies.

- Assess any outstanding liens or claims against the property.

- Ensure compliance with zoning regulations to avoid future conflicts.

- Consult local conveyancers for detailed guidance on title matters.

- Attend to any necessary legal issues before proceeding with purchases.

- Obtain title insurance to safeguard against unforeseen disputes.

- Maintain accurate records of all legal transactions related to the purchase.

By taking these preventive measures, buyers can secure clear titles and protect their investments from potential conflicts, ensuring a more stable property ownership experience.

The Vital Role of Local Conveyancers

In South Africa, local conveyancers play a pivotal role in ensuring property transfers are conducted smoothly and efficiently in Ladysmith. Their expertise in local laws and regulations helps prevent delays and errors during the buying process. By understanding the conveyancer’s role, buyers can navigate the legal landscape more effectively.

Conveyancers are responsible for:

- Drafting and reviewing sale agreements to ensure compliance with regulations.

- Handling all legal paperwork involved in property transfers.

- Verifying title deeds and conducting necessary searches.

- Coordinating with financial institutions for mortgage processes.

- Ensuring that property transfers are registered with the deeds office.

- Providing guidance on tax implications and legal obligations.

- Facilitating communication between buyers, sellers, and other stakeholders.

- Addressing any concerns or disputes that may arise during the process.

By engaging a qualified conveyancer, buyers can navigate the complexities of property transactions with confidence, ensuring that all aspects are handled professionally and efficiently.

Essential Tips for a Successful Property Purchase

Why Early Consultation with Professionals is Crucial

Consulting estate agents and legal professionals early in the property buying process is crucial for first-time buyers in Ladysmith. Engaging with experts from the outset can help navigate complex local regulations and avoid common pitfalls, such as rushed decisions that lead to regrets later.

By seeking professional advice early, buyers can:

- Receive tailored insights based on their specific needs and circumstances.

- Gain clarity on local market trends and property values.

- Understand legal obligations and rights throughout the buying process.

- Establish realistic expectations regarding timelines and costs.

- Access a network of professionals, including inspectors and lenders.

- Receive guidance on negotiations and offer strategies.

- Exploit opportunities for off-market deals through agent connections.

- Foster healthy collaboration, reducing stress and uncertainty.

Incorporating professional advice into the buying journey can yield significant long-term benefits, ultimately ensuring a smoother and more rewarding experience for first-time buyers.

How to Negotiate Effectively for the Best Deal?

Negotiating effectively in Ladysmith’s property market can yield significant benefits for first-time buyers. Employing strategic tactics can ensure buyers secure favourable terms and avoid overpaying for their investment. Understanding how to leverage local market knowledge is essential during negotiations.

Strategies for negotiating the best deal include:

- Researching comparable property sales to frame reasonable offers.

- Gathering data on market conditions to support negotiation points.

- Engaging with sellers to uncover motivations, creating leverage.

- Maintaining a calm and confident demeanour during negotiations.

- Being willing to compromise on non-essential terms.

- Utilising professional agents to facilitate negotiations effectively.

- Presenting offers in writing to enhance seriousness and clarity.

- Being prepared to negotiate contingencies that may add value.

By mastering negotiation techniques, buyers can navigate the property market more effectively, securing opportunities that align with their financial and personal goals.

Planning for Post-Purchase Maintenance

After acquiring property in Ladysmith, first-time buyers must prioritise ongoing maintenance to safeguard their investment. Many overlook vital upkeep tasks that can lead to costly repairs down the line, particularly with respect to roof maintenance in South Africa’s varied climate. Establishing a proactive maintenance plan is essential.

Essential post-purchase maintenance tasks include:

- Regular roof inspections to identify wear from weather conditions.

- Cleaning gutters to prevent water damage to the property.

- Checking for signs of dampness or leaks in plumbing systems.

- Inspecting HVAC systems to ensure efficiency and longevity.

- Maintaining outdoor spaces, including landscaping and fencing.

- Updating safety features, such as smoke detectors and alarms.

- Planning for periodic pest control to prevent infestations.

- Scheduling annual check-ups with qualified contractors for major systems.

A comprehensive maintenance strategy will extend the property’s lifespan and enhance its value over time, ensuring buyers protect their investment and enjoy their homes to the fullest.

Staying Updated on Local Market Trends

Staying informed about local market trends in Ladysmith is vital for first-time buyers aiming to time their purchases wisely. Understanding fluctuations in the property market allows buyers to avoid overpaying during peak times while capitalising on undervalued opportunities for better long-term returns.

Key indicators to monitor include:

- Current property demand and supply levels in various neighbourhoods.

- Seasonal patterns that influence property listings and sales.

- Local economic conditions affecting buyer sentiment and housing availability.

- Average days on the market for properties, indicating buyer interest.

- Changes in interest rates that may impact buyer purchasing power.

- Development plans that could improve or diminish property values.

- Demographic shifts that may alter housing demand patterns.

- Feedback from local agents regarding upcoming trends and insights.

By remaining vigilant and informed about local market trends, buyers can make more strategic decisions, ensuring their investments are both beneficial and aligned with their financial objectives.

Frequently Asked Questions

What Mistakes Do First-Time Buyers Commonly Make in Ladysmith?

First-time buyers in Ladysmith often overlook location factors, skip property inspections, misjudge their budgeting, and allow emotions to drive their decisions, leading to regrettable choices.

Why is Location Important When Buying Property?

Location is crucial as it affects property value, resale potential, and quality of life. Proximity to amenities, crime rates, and future development plans are key considerations.

What Should I Include in My Budget When Buying a Home?

Your budget should account for the purchase price, transfer duties, conveyancing fees, home insurance, maintenance costs, and unexpected expenses to ensure financial stability.

Why Are Property Inspections Necessary?

Property inspections uncover hidden issues like structural damage or outdated wiring. They provide critical insights that can save buyers from costly repairs in the future.

How Can I Negotiate Effectively When Buying Property?

Effective negotiation involves researching comparable sales, understanding market conditions, and engaging sellers to uncover motivations that can help secure better terms.

What Legal Documents Should I Verify Before Purchasing?

Verify title deeds, bonds, zoning certificates, compliance certificates, and property tax statements to ensure clear ownership and avoid future disputes.

What Financing Options Are Available for First-Time Buyers?

First-time buyers can explore various mortgage options, including fixed and variable interest rates, and should consider pre-approval to enhance their buying position.

How Do Interest Rates Affect My Mortgage Repayments?

Interest rates directly influence monthly repayments; higher rates mean higher payments, while lower rates result in more manageable costs. Understanding different rate types is crucial.

What Are Common Hidden Fees in Property Purchases?

Hidden fees include transfer duties, conveyancing fees, homeowners insurance, utility connection charges, and potential renovation costs that can add up unexpectedly.

How Can I Ensure a Smooth Property Purchase Process?

Engage professionals early, conduct thorough research, prepare a comprehensive budget, and remain informed about local market trends to facilitate a successful buying experience.